🏏⚙️ India’s Sports-Tech Surge: Part 1 – Data, Performance & the Race for Fan Attention

The first edition of our research report on India’s sports-tech opportunity, spotlighting startup investment opportunities

Hey founders, funds, & friends 👋,

A warm welcome to the 71st edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about GAMES [Gaming, Ad Tech, Media Tech, Entertainment and Sports Tech] + AI startup and scaleup stories across the Middle East & India, digital / business trends shaping our lives and curated venture investment opportunities.

Go ahead and subscribe below to receive this newsletter with a fresh startup & investor perspective in your inbox every Monday.

Today’s program:

Sports Tech Startups in India: Data & Performance Driving the Next Wave

Key Segments in India’s Sports Tech Ecosystem

Data Analytics and Athlete Performance: A New Playbook

Sports Content and Fan Engagement: New Platforms for a New Audience

And….Action!

Sports Tech Startups in India: Data & Performance Driving the Next Wave

India’s sports technology sector is on the rise, blending the nation’s passion for sports with its prowess in tech. In fact, India now ranks second globally in sports tech investment since 2020 and is home to 350+ sports tech startups (third most in the world). Estimates suggest the Indian sports-tech industry could grow at ~13% annually – from about ₹26,700 crore in FY2024 to nearly ₹49,500 crore by 2029 [advanced-television.com]. This boom is fueled by the digitalization of leagues (exemplified by the tech-savvy IPL), increasing fan engagement, and a new focus on athlete performance solutions.

For a long time, fantasy sports and gaming dominated India’s sports-tech story – fantasy platforms alone generated ₹9,100 crore in FY24. However, recent regulatory hurdles (like higher GST) have slowed that segment. The silver lining is that investors are now eyeing other high-growth areas of sports tech: data analytics, athlete performance enhancement, grassroots talent development, sports content platforms, and smart infrastructure. Early-stage startups in these domains present fresh investment opportunities, and funds are emerging to back them (e.g. Center Court’s ₹350 Cr sports tech fund, and new VCs like Pressplay Capital focusing on where AI meets sports). The government, too, is bullish – initiatives under Khelo India and a Draft Sports Policy 2024 emphasize tech-driven talent identification and training.

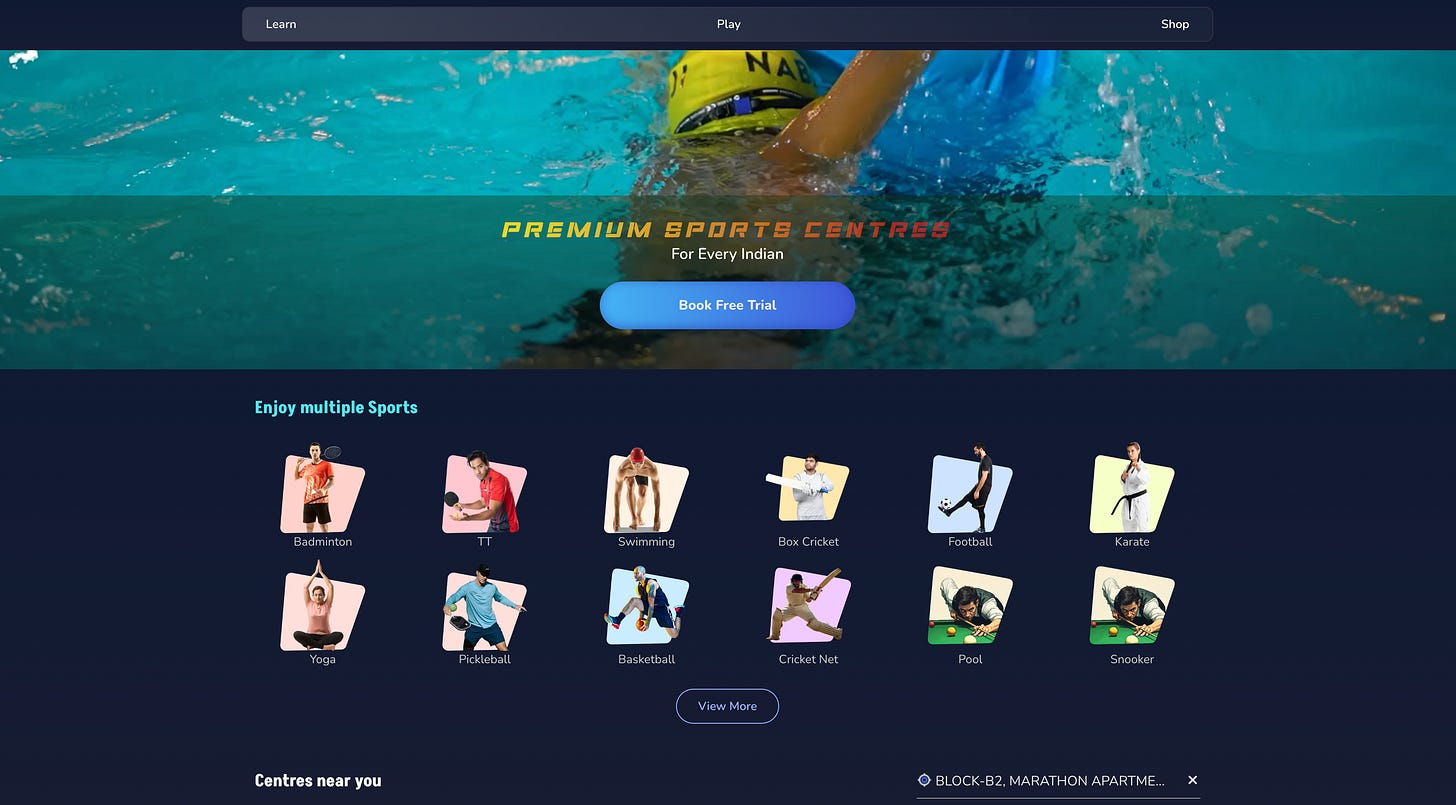

In our 2nd research report [first one focused on Gaming in India], we analyze India’s sports-tech startup landscape with a focus on core sports (excluding fantasy/gaming). We explore key segments – from performance analytics and coaching tech to fan engagement platforms and sports infrastructure – highlighting early-stage startups like Machaxi, Stupa Analytics, and SportVot. We also examine whether startups are building solutions for domestic sports versus global markets (in reality, many do both), and identify trends backed by data and research.

Key Segments in India’s Sports Tech Ecosystem

Sports tech in India spans a broad range of innovations. Below are the major segments and focus areas driving growth:

Athlete Performance & Analytics: Technologies to assess and improve athlete output – including data analytics platforms, AI-driven performance tracking, wearables, and scouting tools. This segment leverages sensors, computer vision, and big data to enhance training, prevent injuries, and refine game strategy. It’s one of the fastest-growing areas as teams and athletes seek a competitive edge from data.

Grassroots Training & Coaching: Solutions that democratize access to quality coaching and talent development. This includes AI-enhanced coaching apps, digital training curricula, and platforms connecting sports academies or coaches with aspiring players. With India’s huge youth population, tech-enabled grassroots programs are a critical opportunity.

Media, Content & Fan Engagement: Platforms that capture, stream, and enrich sports content as well as tools for fan interaction. These range from live-streaming solutions for local matches to AR/VR fan experiences in professional leagues. They aim to bring immersive viewing and deeper fan involvement beyond traditional broadcasts.

Sports Infrastructure & Management: Tech that upgrades the sporting infrastructure – from smart stadium systems (IoT-based crowd management, smart ticketing) to apps for booking sports venues and managing events. Also included are foundational tech (cloud, 5G, IoT) supporting the sports-tech stack.

In the following sections, we dive deeper into these categories, highlighting representative startups and trends in India.

Data Analytics and Athlete Performance: A New Playbook

Data-driven performance optimization has become central to modern sports, and Indian startups are at the forefront of this shift. Sports analytics – collecting and analyzing performance data – is seeing rapid adoption, with the India sports analytics market projected to grow ~15.6% CAGR to reach ~$181 million by 2033 [imarcgroup.com]. Teams across sports are embracing advanced metrics: for example, IPL franchises now deploy real-time data dashboards, GPS trackers, and predictive models to monitor player fatigue, prevent injuries, and devise strategy. Established analytics firms like SportsMechanics (an early mover in this space) and global wearable providers like Catapult are active in India, supporting elite teams with performance analysis.

Crucially, a wave of AI-powered Indian startups is bringing cutting-edge performance analytics to a wider market. These ventures leverage computer vision and machine learning to extract granular insights from video and sensor data. A notable example is Stupa Sports Analytics, a Gurugram-based startup that began in 2020 focusing on table tennis analytics. Stupa’s AI platform provides detailed performance data and video analytics – initially for table tennis, now expanded to badminton and basketball – helping athletes and coaches pinpoint strengths and weaknesses. By partnering with over 15 international federations (including the International Table Tennis Federation and European T.T. Union), Stupa has showcased a “Make in India” solution on the global stage. Its recent ₹28 crore pre-Series A funding will fuel expansion into the US, UK, Australia and beyond, as well as development of more advanced AI capabilities. Stupa exemplifies an Indian startup building a global-first sports analytics product, proving that local expertise in AI can meet worldwide demand for performance data.

Another area of innovation is AI-led coaching and training tools. Bengaluru-based Machaxi blends on-ground coaching infrastructure with digital analytics to improve athlete performance. Founded in 2022, Machaxi operates sports training centers (starting with badminton) and layers an AI-backed training program on top. Through a partnership with legendary Prakash Padukone’s academy, they plan to establish 1,000 badminton coaching centers across India, all using Machaxi’s AI coaching system. The system lets any player record their session via a phone camera, then uses computer vision to suggest corrections in posture, technique, etc., providing real-time personalized feedback. By bringing elite coaching methods to grassroots athletes at scale, Machaxi aims to ensure that “every aspiring athlete… can train with consistency and world-class infrastructure” regardless of location. This tech-driven approach attracted a $1.5M seed round in 2025 led by Rainmatter (Zerodha’s fund) and Padukone himself. It aligns with a broader trend of AI-assisted training: whether through smart wearables (e.g. WHOOP fitness bands launched in India) or sport-specific sensors, athletes are increasingly using data to augment practice. In cricket, for instance, startups like Str8bat and Spektacom have developed bat-mounted sensors that capture swing data to help batsmen fine-tune their technique – highlighting how even a traditionally skill-driven sport is embracing analytics at the athlete level.

These innovations are supported by India’s growing sports science ecosystem. The government’s Khelo India program, through initiatives like KIRTI (Khelo India Rising Talent Identification), is deploying AI and data analytics at Talent Assessment Centres nationwide to scout and nurture young talent. A National Sports Science Database has been created to track athlete testing data and shape training protocols. Such efforts address a key challenge: the lack of structured data on the millions of athletes in India’s tier-2 and rural areas. Startups like ScoutEdge are beginning to fill this gap by building data-driven scouting platforms for under-the-radar talent. While experts caution that AI won’t replace human coaches or scouts entirely (context and human judgment remain vital in talent assessment), there’s consensus that data analytics can greatly enhance decision-making and broaden the talent pipeline. As one venture investor noted, huge “white space” remains in areas like tracking athlete performance and simplifying talent discovery, meaning these data-centric startups have only scratched the surface of their potential.

Importantly, the athlete performance tech segment is poised for global growth. Worldwide, AI in sports is projected to grow from about $1.03 billion in 2024 to $2.61 billion by 2030 (16.7% CAGR). Indian startups are well-positioned to ride this wave by offering cost-effective, innovative solutions to teams and federations everywhere. We are already seeing this with exports like Stupa and computer-vision platforms such as Matchday.ai, which can auto-track players and log tens of thousands of data points from a single match video. In short, data and analytics in sports are becoming indispensable – and India’s entrepreneurs are turning this into a fast-growing business vertical. By leveraging AI to enhance training, recovery, and strategy, these startups promise not just better athletic performance but also more scouting insights and injury prevention, fulfilling a pressing need in the sports ecosystem.

Sports Content and Fan Engagement: New Platforms for a New Audience

Beyond the playing field, sports tech startups in India are innovating in how sports are experienced by fans and covered across media. A major trend is the rise of accessible sports content platforms that live-stream games and spotlight grassroots talent. One standout is SportVot, a Mumbai-based startup (founded 2019) that has built a cloud platform to broadcast local sports events with near TV-level quality. Using a proprietary cloud-based production suite, SportVot enables small clubs, school tournaments, and state leagues to stream matches cheaply – often with a single camera operator – drastically lowering the barrier for televising sports. In the past few years, SportVot has helped digitize over 350,000 matches across 30 different sports, from cricket to kabaddi, many of which never had any exposure before. This not only gives fans new content to follow, but also helps unknown athletes build a digital profile and showcase their skills to scouts and sponsors.

Having achieved significant traction in India, SportVot is now expanding globally to regions like Southeast Asia, Australia, the Middle East and parts of Europe. These markets have vibrant grassroots sports scenes but limited access to affordable broadcasting, a gap SportVot aims to fill. The platform already partners with cricket boards in Japan, Thailand, Afghanistan, Saudi Arabia and others to stream local cricket matches. It even teamed up with ITTF Oceania to live-stream a continental table tennis event – a testament to the platform’s versatility beyond just Indian sports. As co-founder Siddhant Agarwal explains, “Local sports across the world are rich in talent but often lack the visibility and infrastructure needed to grow. Our aim is to bridge that gap by making broadcasting accessible and enabling athletes at all levels to build a digital identity”. By also providing features like live scoring, automated on-screen graphics, player stats, and monetization tools (pay-per-view, ad integration), SportVot helps organizers generate revenue and fans engage more deeply. In essence, startups like this are democratizing sports media, ensuring that the next sports star from a small town can gain followers long before they reach a pro stadium.

On the professional end of the spectrum, fan engagement technology is enhancing how audiences interact with big-league sports. With IPL and other major leagues pushing the envelope, innovations in AR/VR and second-screen experiences are emerging. For example, recent IPL seasons have experimented with augmented reality stats and immersive camera angles for TV viewers. Some broadcasters offer VR highlights or 360° replays that fans can experience through headsets, virtually “placing” them on the field. Teams and leagues are also launching fan apps with interactive features – from predicting outcomes to accessing exclusive camera feeds – gamifying the viewing experience (though strictly sports games, not betting). We’ve also seen the advent of digital fan tokens and collectibles (e.g., cricket NFT platforms) aimed at boosting fan loyalty, although that craze has tempered.

Crucially, India’s massive digital audience (over 700 million internet users) makes it fertile ground for sports fan-tech adoption. Even beyond cricket, sports like football, kabaddi, and badminton are cultivating engaged fanbases through tech platforms. Startups and media ventures are catering to this multi-sport appetite: for instance, Dream Sports (parent of Dream11) launched FanCode, a streaming and e-commerce app that broadcasts domestic and international matches of various sports and sells merchandise. Another example is KreedOn, a sports media startup that creates content around Indian athletes and runs fan communities to support Olympic sports. While these companies are a bit more mature, new entrants continue to appear with niche focuses – be it a hyper-local sports news app or a social network for amateur athletes.

It’s worth noting that the fan engagement segment was the largest contributor to sports-tech revenues (due largely to fantasy gaming). Now, as fantasy platforms face headwinds, other forms of engagement like direct-to-consumer sports streaming, interactive fan platforms, and training content for enthusiasts are picking up steam. Investors see potential in these models to capture the attention of India’s young, digital-native sports fans. Indeed, sports tech is part of the broader “attention economy,” and upcoming funds like Pressplay Capital want to explicitly target this intersection of sports, media, and technology. As sporting content becomes more on-demand and personalized, expect further innovation in how fans consume sports – whether it’s community-driven commentary, AI-curated highlight reels, or virtual reality fan zones on match days. The ultimate goal is to make sports viewing more immersive and participatory, keeping fans engaged beyond just watching passively.

Coming up in Part 2 of our Sports-Tech Opportunities Report (out in a few days): “Infrastructure & Grassroots – Building India’s Sporting Pipes.”

📬 Subscribe to our newsletters for deep dives into the attention economy & media-tech:

Mehtta Ventures Dubai (Attention Economy) – Subscribe here

The Streaming Lab (Streaming Industry) – Subscribe here

+ 🎙️ Follow our Pressplay Podcast for conversations with leading entrepreneurs (and VCs coming up) in the space:

Watch on YouTube – Pressplay Capital

> PressPlay is where the attention economy meets real builders.

> We’re excited for the future of media-tech and AI-driven streaming—and look forward to partnering with those who share our vision.

Interested Investors / Limited Partners, please go ahead and book time with us here

If you know of startup founders building in the “eyeball economy”, please go ahead and connect us. Let’s pay it forward together :-) 2025 it is!

Watch this space and subscribe / share with your friends.

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brand across 7 billion + impressions per month including 150+ publishers, OTTs and broadcasters in the Middle East and several more in India, APAC, Europe and the United States. Contact me here.