Sprive: Revolutionizing Mortgage Management with Data-Driven Innovation - Get Mortgage Free, Faster

Our first startup investment opportunity in the UK

Hey founders, funds, & friends 👋,

A warm welcome to the “lucky” 13th edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about startup stories across the Middle East & India, digital / business trends shaping our lives and curated venture investment opportunities.

If you are not already a subscriber, please sign up below and join several others who receive it directly in their inbox every Monday.

Shorooq Partners launches a new $100 million venture debt fund, hits first close

Abu Dhabi-based Shorooq Partners has unveiled a new $100 million venture debt fund, marking the first close of this significant financial endeavor. Although the exact amount raised in this initial phase remains undisclosed, the fund signifies Shorooq's continued commitment to providing alternative financing solutions in the MENA region.

Historical Context and Previous Success

This latest fund represents Shorooq's second foray into the venture debt space. Their inaugural debt fund, launched over three years ago in collaboration with Korean venture capital and private equity firm IMM Investment Global (IMMG), has been fully deployed. This initial fund backed high-profile companies such as Pure Harvest, an innovative agriculture tech firm, and Tamara, a leading Saudi fintech company. Notably, Tamara secured $250 million in debt financing in November of the previous year, with $50 million contributed by Shorooq and the remaining $200 million from Goldman Sachs.

Strategic Partnerships and Investment Focus

For the second venture debt fund, Shorooq has renewed its partnership with IMMG, which will participate as a minority partner. Shorooq's statement emphasized the success of their first debt fund, highlighting how the funded ventures have emerged as industry leaders, driving innovation and economic growth.

This new fund will target Series A+ companies, particularly those in manufacturing, financing, and software services, with each investment averaging $10 million or more. This strategic focus aims to support mature companies with recurring revenue streams, strong cash flow, and tangible assets, providing a non-dilutive financing option that contrasts with traditional equity funding.

Founders' Vision and Market Impact

Shorooq Partners, founded in 2017 by Shane Shin and Mahmoud Adi, began as a venture capital firm but has since evolved into an alternative investment manager. Their portfolio spans multiple venture capital and debt funds, investing in startups across the MENA region. Besides Pure Harvest and Tamara, Shorooq's notable investments include Nymcard, Sarwa, Lean Technologies, Trukker, and Lendo.

Shane Shin, a founding partner, stressed the importance of non-dilutive financing, especially in the MENA region, where such funding methods are becoming increasingly popular among founders. Shin highlighted the advantages of non-dilutive funding for companies that have completed Series A rounds, offering them a viable path for sustained growth.

Future Prospects and Market Demand

Nathan Kwon, a principal at Shorooq Partners and leader of the new fund, noted a significant surge in deal flow, with over $400 million screened last year. This interest underscores the growing demand for scalable growth solutions among companies in the region. The robust deal flow signals strong market interest and the potential for Shorooq's fund to significantly impact the growth trajectory of mid-stage companies in the MENA region.

Conclusion

Shorooq Partners' launch of its second venture debt fund, in partnership with IMMG, represents a pivotal development in the MENA fund raise ecosystem. This fund not only supports the region's growing appetite for non-dilutive financing but also highlights Shorooq's role in driving innovation and economic growth across various sectors.

Today’s program:

Digital Companies changing the “Mortgage” landscape in the UK

Startup Deal #13, Sprive: Revolutionizing Mortgage Management with Data-Driven Innovation

And….Action!

Digital Companies changing the “Mortgage” landscape in the UK

The Disruption of the UK Mortgage Market by Digital Startups

The UK mortgage market is experiencing a significant transformation as digital upstarts and startups introduce innovative solutions to streamline the mortgage process. These new entrants provide digital platforms that simplify mortgage comparison, application, and approval processes, challenging traditional mortgage lenders and brokers.

Online Mortgage Aggregators

Digital mortgage aggregators offer services similar to other online financial product aggregators, providing a standardized user experience (UX) that allows users to compare multiple mortgage providers quickly and for free.

Overview: One of the most popular digital mortgage brokers.

Features: Fully digital and free to use, helping users find the best mortgage deals and acting as a broker on their behalf.

User Experience: The platform offers a clear, user-friendly experience with a memorable website design, setting it apart from traditional banking sites.

Overview: Another online mortgage advice aggregator.

Features: Supports users in identifying and comparing mortgage deals, aimed at first-time buyers and those looking to remortgage.

User Experience: Basic web experience that directs users to arrange a callback, indicating a partially digitized process.

Overview: A web-first mortgage provider.

Features: Free service offering both mortgage and remortgage products.

User Experience: Clean and modern UX, encouraging users to sign up and provide their information before receiving mortgage recommendations.

Peer-to-Peer (P2P) Lending Platforms

P2P lending platforms focus on buy-to-let mortgage takers and act as investment vehicles for those looking to make property-backed investments with reduced risk.

Landbay

Overview: Digital platform for buy-to-let and portfolio landlords.

Features: Allows individuals and companies to invest in real estate through a P2P model.

User Experience: Digitized offering that still encourages user contact via email or telephone, indicating a blend of digital and traditional interactions.

LendInvest

Overview: Specializes in buy-to-let, bridging loans, and investment management.

Features: Provides opportunities for both individuals and institutions to invest in property-backed loans.

User Experience: Similar to Landbay, it combines digital services with prompts for direct contact through email or telephone.

Digital Mortgage Issuers

A few mortgage issuers have transitioned from brick-and-mortar operations to online platforms, maintaining similar business models and services.

Molo

Overview: Digital buy-to-let mortgage provider.

Features: Emphasizes speed, simplicity, honest communication, and straightforward language.

User Experience: Offers an end-to-end online mortgage application process, handling all procedures digitally, making it one of the closest to a truly digital mortgage provider.

App-Based Banks

The UK boasts a high penetration of challenger banks, but few focus on mortgages. However, app-based banks are a logical next step for disrupting the mortgage market.

Atom

Overview: One of the first UK neobanks to offer mortgages.

Features: Provides mortgages to first-time buyers and those remortgaging.

User Experience: Exclusively mobile app-based, differentiating it from web-based offerings.

Future Outlook

The mortgage industry is currently in a phase reminiscent of the everyday banking sector in 2015, with digital channels emerging but not yet fully disruptive. However, as the target demographic for mortgages increasingly includes millennials, the demand for flexibility, enhanced UX, and corporate social responsibility (CSR) in mortgage offerings is rising. Providers that effectively blend these elements are poised to lead the disruption and gain a competitive edge in the market.

Startup Deal #13, Sprive: Revolutionizing Mortgage Management with Data-Driven Innovation

Industry: Fintech / Housing

Headquarters: London & Bangalore

Fund Raise Ask: GBP 1.5 million, Pre-Series A

Traction: GBP 673K Monthly Gross Revenue, GBP 44K Monthly Net Revenue, GBP 35 ARPU, 15.4K Monthly Active Users

Founders: Jinesh Vohra, Saad Hashim and Anand Pankhania

Business Model: B2B2C

Invest in Sprive: Revolutionizing Mortgage Management

Overview: "Mortgage Free, Faster"

In the UK and the US, managing outstanding debt is the largest financial pain point for 384 million people. Specifically, in the UK, interest payments on personal debt amount to £73 billion annually. Sprive aims to alleviate this burden by helping homeowners pay down their mortgages faster and more efficiently. Our platform is designed to be the ideal solution for managing personal finances, starting with mortgages.

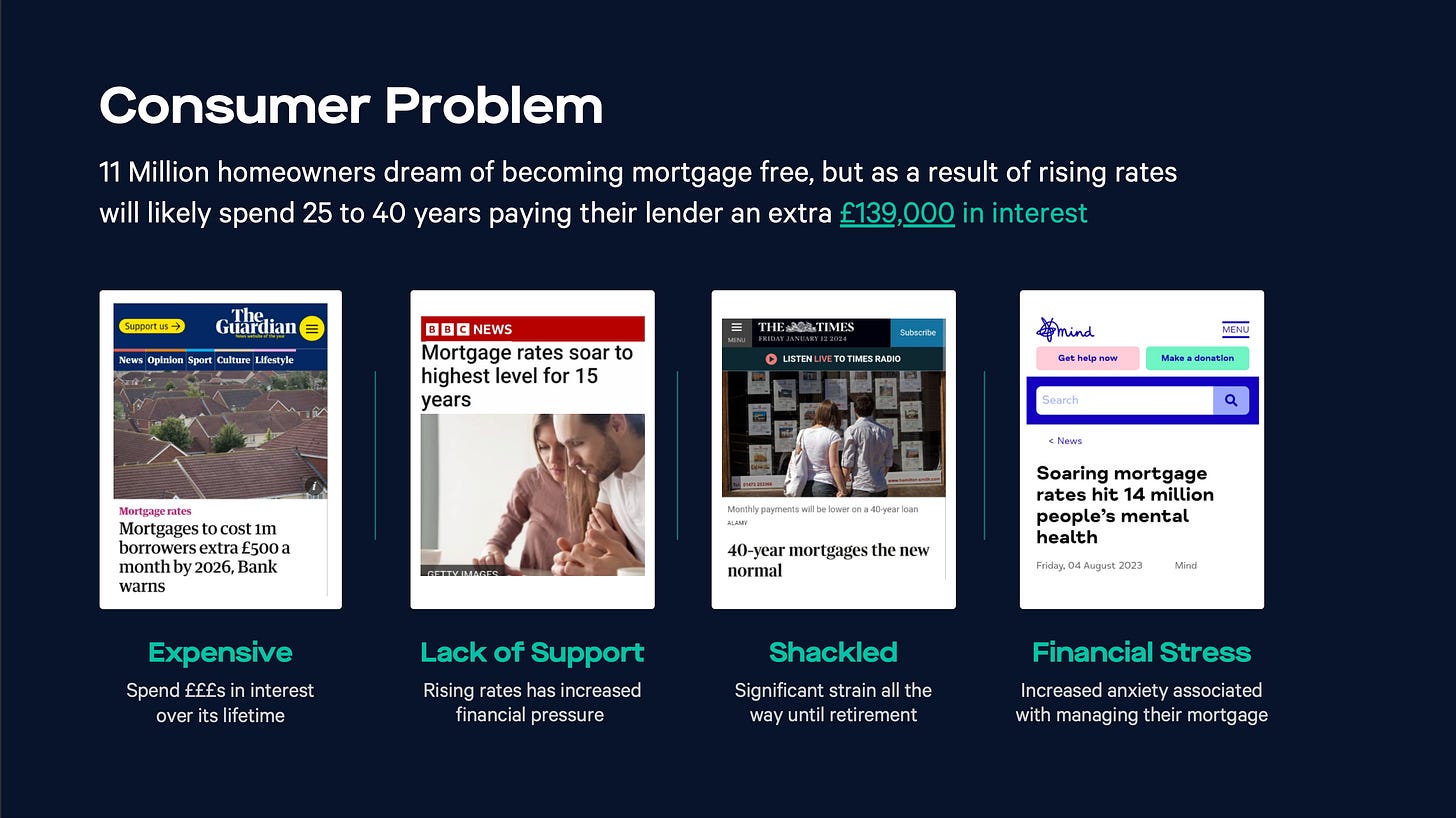

The Consumer Problem

Millions of homeowners dream of becoming mortgage-free. However, rising interest rates mean they are likely to spend an additional £139,000 in interest over 25 to 40 years. The key issues faced by these homeowners include:

High Costs: Significant financial strain lasting until retirement.

Lack of Support: Paying excessive amounts in interest over the mortgage's lifetime.

Financial Stress: Increased anxiety due to rising rates and the associated financial pressure.

Sprive’s Solution

Sprive is an innovative app that helps homeowners pay off their mortgages faster by leveraging spare cash from their everyday spending. Key features of the app include:

Smart Savings: Identifying and using spare cash based on user spending to pay off mortgage debt quicker.

Earning Opportunities: Users can earn money towards their mortgage every time they shop or complete a survey.

Market Monitoring: Continuous monitoring of the mortgage market to ensure users are always on the best deal.

Market Potential

The mortgage market in the UK alone is worth £1.6 trillion. By providing a data-driven, performance-oriented solution, Sprive is positioned to capture a significant share of this fragmented market. With over 20,000 mortgage advisors operating traditionally, Sprive's digital approach allows for rapid customer acquisition at a low cost.

Competitive Advantage

Customer Engagement: Unlike traditional players who engage with customers every 2 to 5 years, Sprive interacts with homeowners monthly.

Superior Customer Service: By electronically sourcing data on spending, mortgage, credit, and property during onboarding, Sprive ensures seamless lender payments and remortgage experiences.

Efficient Operations: Sprive's team includes experienced professionals from banking, data science, and fintech sectors. Our operational costs are kept low by leveraging talent from India, with a monthly wage bill of just £11k for seven engineers.

Business Model: The Sprive Marketplace

Sprive generates revenue through commissions from merchants and mortgage lenders for every transaction processed via the app. Rising interest rates and strong word-of-mouth referrals have driven 50% of our growth in 2024, positioning us well for scalable growth.

Investment Opportunity

The Ask

We are seeking to raise £1.5 million to:

Achieve £250K+ Monthly Recurring Revenue (MRR)

Prepare for a Series A funding round

Why Invest in Sprive?

Sprive offers a unique and scalable solution to a significant financial problem faced by millions. With their innovative approach and strong market potential, Sprive is well-positioned to disrupt the mortgage industry and deliver substantial returns for investors.

Contact Us

For more information about this deal and other startup investment opportunities, please contact me at viniitmehta@mehttaventuresdubai.com OR book time via my scheduling link here.

Join us in revolutionizing the mortgage management industry and helping millions become mortgage-free, faster.

This professional and detailed pitch is designed to attract high-net-worth individuals and venture capitalists in the Middle East and India, showcasing the immense potential and innovative approach of Sprive in transforming the mortgage market.

Stay tuned to our newsletter for more exciting investment opportunities and industry insights and also share it with folks in your network who might be interested!

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brand across 7 billion + impressions per month including 150+ publishers, OTTs and broadcasters in the Middle East and several more in India, APAC, Europe and the United States. Contact me here.