The Attention Economy Has Tailwinds. Pressplay Has the Toolkit.

WAVES 2025 signals momentum. Our fund brings capital, distribution, and exits into focus.

Hey founders, funds, & friends 👋,

A warm welcome to the 61st edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about GAMES [Gaming, Ad Tech, Media Tech, Entertainment and Sports Tech] + AI startup and scaleup stories across the Middle East & India, digital / business trends shaping our lives and curated venture investment opportunities.

Go ahead and subscribe below to receive this newsletter with a fresh startup & investor perspective in your inbox every Monday.

Is India finally giving the attention economy the policy priority it deserves? ✊

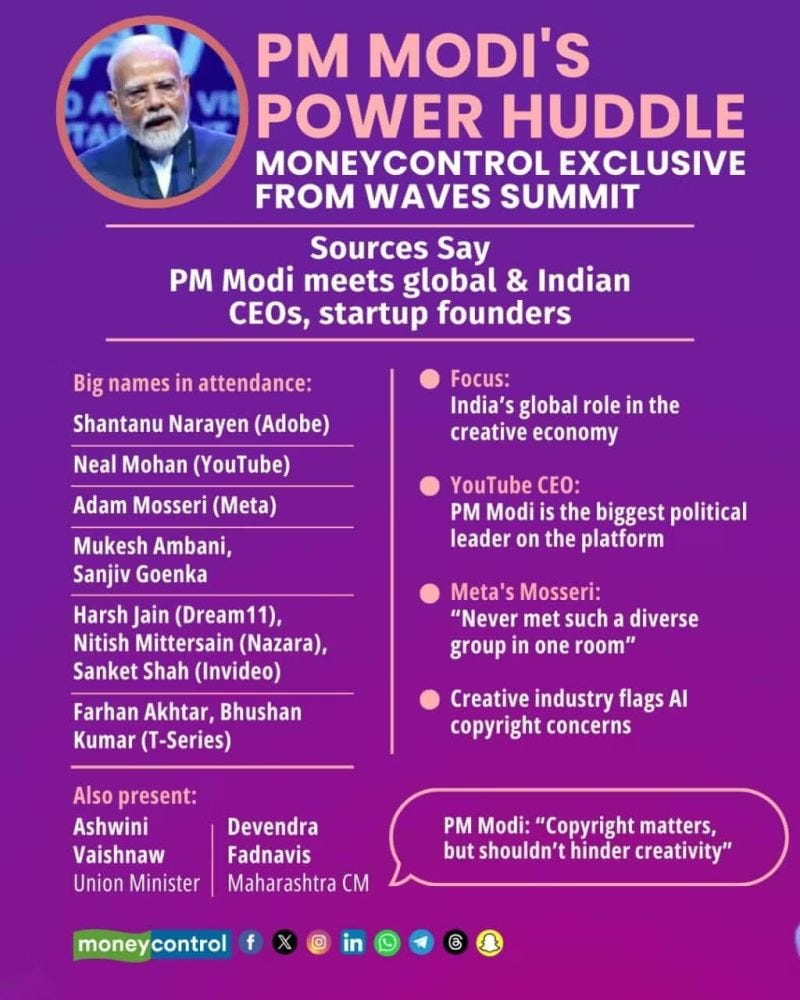

We’re thrilled to see what unfolded at the inaugural Waves event in Mumbai, organized by the Ministry of Information and Broadcasting, Government of India — where PM Modi met with leaders from Adobe, YouTube, Instagram, and Indian creators to discuss AI, creativity, and copyright in a global digital-first economy amongst a host of other celebrity panelists, startup founders, investors and attention economy stakeholders to position India as a true “media” powerhouse

At Pressplay Capital, this is exactly the kind of momentum we’ve been building our fund thesis around:

Advancing streaming, content, and media-tech in an AI-powered era — across Gaming, Ad Tech, Media, Entertainment, and Sports Tech (GAMES).

While I couldn’t attend this year, we plan to make WAVES a regular stop starting next year. It’s clear that the world is watching India emerge not just as a consumer market — but as a creator and innovation powerhouse in content, storytelling, and digital IP.

WAVES is a signal — that India is serious about shaping the future of the global attention economy.

If you're building something at this intersection — we’re all ears.

Today’s program:

Importance of Legal and Taxation Experts for VC Funds

How will we help our Portfolio Companies? And thereby our first Customers - the Limited Partners (LPs)?

And….Action!

Importance of Legal and Taxation Experts for VC Funds

The Strategic Imperative of Legal and Tax Expertise for VC Funds in the UAE

Establishing a venture capital fund in the UAE, particularly within financial hubs like the Dubai International Financial Centre (DIFC) or Abu Dhabi Global Market (ADGM), necessitates a deep understanding of the evolving legal and tax landscape.

Navigating the Corporate Tax Regime

With the introduction of the UAE's federal Corporate Tax Law, effective for financial years starting on or after 1 June 2023, VC funds must be vigilant. While Qualifying Investment Funds can attain tax-exempt status, this is contingent upon meeting specific criteria, including regulatory oversight and diversity of ownership . Failure to comply can result in a 9% corporate tax on taxable profits.

Audit and Compliance Obligations

Entities within DIFC and ADGM are mandated to maintain accurate accounting records and submit audited financial statements annually. Non-compliance can lead to penalties up to USD 25,000 in DIFC and USD 15,000 in ADGM . Engaging proficient legal and tax advisors ensures adherence to these obligations, safeguarding the fund's operational integrity.

Leveraging the UAE-India DTAA

For VC funds targeting Indian startups, the Double Taxation Avoidance Agreement (DTAA) between the UAE and India is pivotal. This treaty mitigates the risk of double taxation on income such as dividends and capital gains, enhancing the attractiveness of cross-border investments . Proper structuring, aligned with DTAA provisions, is essential to optimize tax efficiency.

Conclusion

In the dynamic regulatory environment of the UAE, integrating legal and tax expertise into the fund's foundation is not optional—it's strategic. At Pressplay Capital, we prioritize these aspects to ensure our investments are not only compliant but also optimized for sustainable growth.

How will we help our Portfolio Companies?

Capital to kickstart innovation

Modus Operandi is to invest ~ $300,000 in 15 startups that have proven traction / revenues, strong teams, and exit optionality.

$700,000 in the Top 5 performing companies as a follow on investment

Valuations of the startups ideally below $15 million (in some cases we are already able to negotiate lower valuations given the impact that we can create by being on the cap table)

Domain-Led GTM Acceleration

Deep Media Tech & Streaming Experience, Expertise and Network across India, MENA and United States.

Partnership facilitation and Distribution hacks to achieve significant and sustainable revenue growth for portfolio companies and entrepreneurs.

2 Weekly newsletters going out to 5000+ subscribers including global leaders in the attention economy

Some examples include global partnership facilitation for Video AI startup with leader in the Online Video Platform (OVP) space which gave the startup access to 200+ publishers globally (their target customers) + Fastest growing Ad Tech networks’ access distribution to 50+ global companies working at the intersection of Streaming, Connected Television and also Sports Platforms

Monetization Playbooks

Our Board Observer position at Adsolut Media, Asia’s second largest video ad network after YouTube gives us the advantage of offering “ad tech” / monetization solutions to platforms / businesses in the digital attention economy including in-app / games, pre-roll video, connected tv and OTT display & video ads for additional revenues.

Beyond Adsolut Media, we have associations with several other global agencies for sponsorship and brand endorsements which could help as well.

On the subscription economy side, technology partners such as Evergent; telco partners such as Reliance Jio, Etisalat etc round up additional distribution and monetization angles.

Infra + Ecosystem Leverage

We are working with leaders across the major cloud providers Google Cloud, Amazon Web Services, Microsoft Azure etc to offer significant “cloud credits” to startups that are part of our portfolio.

Direct access to the leaders at these organizations (in a few cases directly at HQ in the US) makes it easier for us to negotiate strong deals, value added products and cloud credits for startups that we invest in thereby offering cheaper infra options.

Exit-Ready Structuring

Exit is a Core Investment Filter: Every deal we evaluate is mapped against potential exit scenarios—be it M&A, acqui-hire, or secondary. We prioritize opportunities where strategic acquirers are visible early and a clear path to liquidity exists within a 3–7 year window.

Active Exit Intelligence & Relationship Building: We constantly track exit activity across our core geographies (India, Middle East, US) and maintain direct relationships with scaled players in the attention economy—media-tech, gaming, adtech, and sports—so we know what they’re actively looking to acquire.

Sector Focus = Strategic Fit: Unlike sector-agnostic funds, our deep specialization allows us to guide startups toward features, distribution capabilities, and monetization models that align with acquirer interest—plugging into real gaps and accelerating exit-readiness.

📬 Subscribe to our newsletters for deep dives into the attention economy & media-tech:

Mehtta Ventures Dubai (Attention Economy) – Subscribe here

The Streaming Lab (Streaming Industry) – Subscribe here

+ 🎙️ Follow our Pressplay Podcast for conversations with leading entrepreneurs (and VCs coming up) in the space:

Watch on YouTube – Pressplay Capital

> PressPlay is where the attention economy meets real builders.

> We’re excited for the future of media-tech and AI-driven streaming—and look forward to partnering with those who share our vision.

Interested Investors / Limited Partners, please go ahead and book time with us here

If you know of startup founders building in the “eyeball economy”, please go ahead and connect us. Let’s pay it forward together :-) 2025 it is!

Watch this space and subscribe / share with your friends.

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brand across 7 billion + impressions per month including 150+ publishers, OTTs and broadcasters in the Middle East and several more in India, APAC, Europe and the United States. Contact me here.