The Middle East "Football" Fan Engagement Opportunity

Global Sports Tech Startups are our first bets for Deal Warehousing

Hey founders, funds, & friends 👋,

A warm welcome to the 67th edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about GAMES [Gaming, Ad Tech, Media Tech, Entertainment and Sports Tech] + AI startup and scaleup stories across the Middle East & India, digital / business trends shaping our lives and curated venture investment opportunities.

Go ahead and subscribe below to receive this newsletter with a fresh startup & investor perspective in your inbox every Monday.

What brings my dad, son, and I together at 7am in Dubai?

Cricket!

Not board meetings. Not screen time limits. Not even breakfast.

Last night, the three of us watched the South Africa–Australia World Test Championship final — full of banter, analysis, and “back in my day” stories; especially the chats between my dad and son were magical.

And this morning, we took it a step further: we were on the field playing a game of our own.

Watching my father and son bond over cricket was something else. One is a doctor who’s been playing cricket for 60 years. The other is still deciding whether to bowl spin or pace. I was the only one getting hit for boundaries.

Sports, more than anything else, bridges generations.

It’s the simplest and strongest form of connection — whether you’re a pro, a hobbyist, or a spectator.

It inspires improvement, creates conversation, relieves stress, and brings joy across any kind of downturn — economic or emotional.

It’s one of the reasons sports tech is core to our thesis at Pressplay Capital.

Everyone wants to play better, recover faster, and enjoy more — and we think tech will play a huge role in enabling all three.

Oh, and yes — both my dad and my son bowled to me this morning.

Any guesses who got me out?

Let’s just say… I’m still not hearing the end of it.

Excited to share that our very first warehouse deal at Pressplay Capital is in the "sports tech" space — more on that soon!

Today’s program:

The Middle Eastern Football Fan Engagement Opportunity

Gamification, UGC & Rewards: Hooking the Next-Gen

Monetization & Fan Data

Why Now? First-Mover & Regional Growth

And….Action!

The Middle Eastern Football Fan Engagement Opportunity

Football (soccer) is a dominant cultural force across MENA, and the region’s youth population makes it a fertile ground for mobile-first fan engagement. FIFA estimates ~5 billion global football fans, with Latin America, the Middle East and Africa among the largest fan bases worldwide. In the Middle East, digital sports media already reach hundreds of millions: FootballCo’s networks (GOAL, KOOORA, etc.) claim 192 million MENA fans each month. Plus Kings League MENA just announced a joint venture with Saudi PIF/SURJ Sports! [Aimed at a youth demographic where ~70% of the population is under 30 + Formats include open tryouts, celebrity team presidents (streamers and creators from across Arabia and North Africa), and digital-native match experiences.]

Local leagues are booming too. The Saudi Pro League (SPL, now Roshn League) added 25% more stadium-goers in late 2023 than a year prior (≈440K fans in six weeks arabnews.com ) thanks to marquee signings like Ronaldo, Neymar and Benzema. These stars have supercharged engagement: the SPL reports ~1.5 million net new social media followers and 150 million video views so far in the season. Notably, 40% of the combined 1.5 billion followers of Saudi league stars are aged 18–24 , underscoring youth interest. Governments are supporting this surge: Saudi Vision 2030 explicitly highlights football as a “cultural touchstone”, and billions are being invested in infrastructure (stadiums, youth programs, the 2034 World Cup bid) to sustain fan growth.

Gen Z: The Mobile-First, Content-Hungry Fan

The demographics amplify this trend. Over half of the MENA population is under 30 (≈55% across the region, 63% in Saudi beautymatter.com ), and these young people are digital natives. In Saudi Arabia, 97% of residents have smartphones and 82% use social media. Region-wide, 90%+ of consumers report mobile as their top device for news, and 68% say social media is their primary news source consultancy-me.com consultancy-me.com . Short-form video is king (66% prefer mobile video) . These usage patterns carry over to sports. A 2024 Altman Solon survey finds the share of Middle Eastern 16–24-year-olds interested in sports jumped from 27% (in 2021) to 36% – higher than U.S. or European Gen Z.

Analysts attribute this to the local sports renaissance: watching global stars like Ronaldo play in Riyadh “creates a sense of pride and immediacy” that turns young viewers into regular fans. Practically, this means Gen Z fans are online, mobile, and social. They want access to highlights and commentary on TikTok/Instagram, not just TV broadcasts.

For instance, FootballCo’s GOAL brand launched “Yalla SPL” – a TikTok/YouTube show targeting English-speaking Gen Z – which drove 335 million social video views in Dec 2024 alone. The SPL’s official TikTok channel now boasts 2.5 million followers (44.2 million likes) . These trends imply the massive smartphone-based audience is waiting for interactive experiences: live clips, memes, chats and games on mobile, rather than linear TV.

Gamification, UGC & Rewards: Hooking the Next-Gen

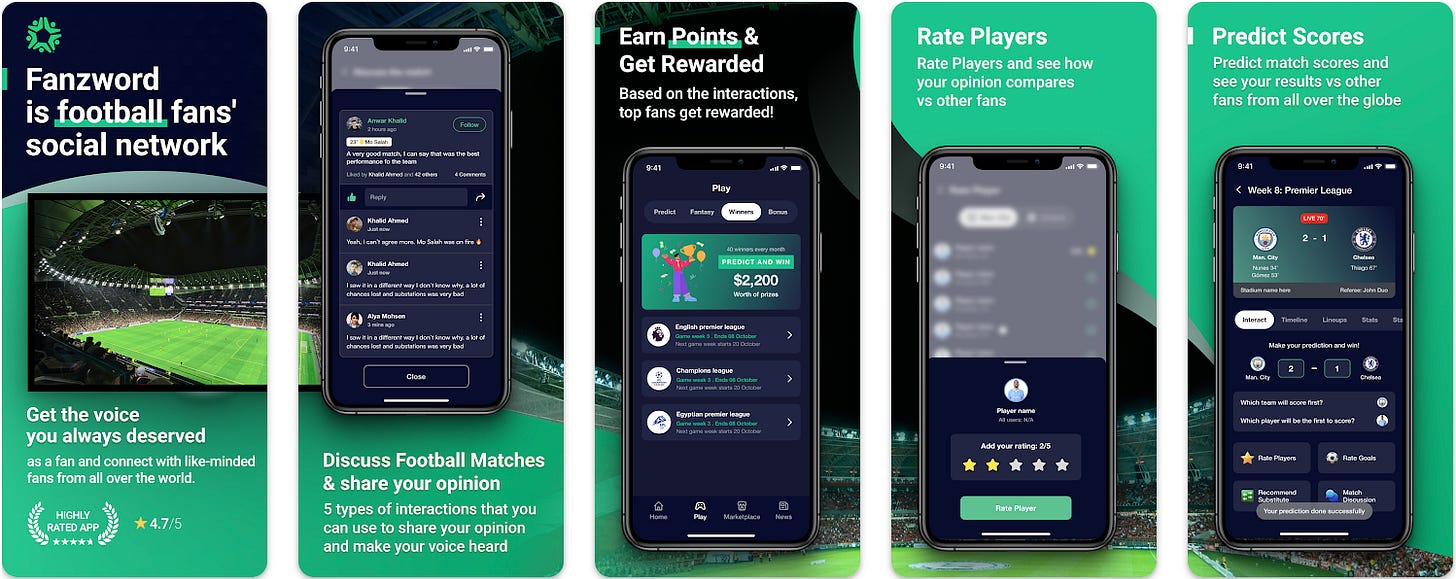

Fan Gen Z fans expect to participate, not just watch. In this growing arena of football-focused engagement apps, several regional startups are building toward what the next generation of fans expects: gamified, always-on, mobile-first football ecosystems. One particularly fast-growing platform that we are tracking has already surpassed 900,000 registered users, 175,000 monthly active users, and 35 million in-app game interactions. Its edge? A powerful blend of gamification, user-generated content (UGC), live match interaction, and fan rewards — all packed into a sleek, mobile-first experience that speaks to the TikTok generation.

This platform is designed to feel like a game itself: users compete in trivia, rate live match events (like goals or substitutions), earn coins and club tokens, and unlock real-world prizes like cash, crypto, or even gold. With retention metrics exceeding 35% MoM and a 4.7/5 user rating across 40,000+ reviews, it is already becoming the default second-screen for football fans aged 13–25 across the region.

But its real moat? Fan data. It’s the first and only regional platform providing real-time fan sentiment and gameplay data — powering player ratings, goal reactions, and substitution feedback from actual users — and publishing that as part of a structured analytics layer. The platform is even listed on Snowflake’s global data marketplace, giving rights-holders, advertisers, game publishers, and research firms access to over 30 million data points of fan behavior. In a region where clubs, leagues, and sponsors are still building their direct-to-fan digital muscle, this is a first-mover opportunity in first-party fan data.

The monetization potential is equally layered:

Ads: CPMs up to $10 for contextual brand engagement

In-app purchases & subscriptions: Up to $3 per user per month for premium tools and experiences

Fan data analytics as a service: Licensing data to 100+ partners via B2B channels

Backed by a strong team of product, growth, and engineering leads (including alumni from Vodafone, Breadfast, and media agencies), the company has some great news coming up — adding not just credibility but potential distribution power across La Liga and Middle East fanbases.

Fan engagement apps are weaving gamification and user-generated content (UGC) into the football experience. Many regional startups have built quiz and fantasy games with leaderboard rewards. For example, Boomer11 (UAE) is a mobile-first app offering daily fantasy contests, sports quizzes and an “engagement wall” of exclusive clips (highlights, updates, stats). Users form fantasy teams each matchday and earn virtual “Boomer coins” for good performance or referrals; those coins redeem for real prizes (TVs, gaming gear, vouchers, even gold coins). Boomer11 reports ~15,000 users (≈80% UAE) spending about 30 minutes per day on the app, all organically and largely via word-of-mouth. Similarly, Eksab (Egypt) runs prediction and fantasy leagues across MENA/Africa. It offers free and premium contests with cash prizes and merchandise rewards, plus editorial content to help users make picks. Eksab’s roadmap even includes “play-to-earn” NFTs and collectibles, blending traditional fantasy with Web3. Crucially, these features resonate with the region’s digital youth: 67% of Saudi nationals game on digital devices, and survey data show Gen Z “want to create content as much as consume it”. On UGC, new apps like Fanera are positioning themselves as football-only social networks. Fanera’s founders emphasize that existing social platforms (Instagram, Twitter) distract fans with unrelated content; dedicated apps let fans share memes, blog posts, and videos with each other and with clubs. The Fanera platform is free for fans, and over time it has grown via community support (even winning Qatar 2022’s challenge) by tapping into fans’ desire to publish and discuss football in one place.

Regional Platforms & Competitors

Boomer11 (UAE) – Features: Mobile-first sports app (football & cricket focus) with daily fantasy, quizzes, live score feeds and short videos . Gamification is central: users earn “Boomer coins” redeemable for physical prizes (electronics, gift cards) by winning contests and inviting friends . Traction: Launched 2021; ~15K users, ~30 min/day engagement. Monetization: Core gameplay is free; revenue from branded content, sponsorships and future in-app purchases. Boomer’s founders plan to leverage region-wide sports events and youth eSports interest to scale engagement.

Fanera (UAE) – Features: Social fan network for football. Fans, influencers, players and clubs post content in a unified app. It’s “for and by football fans” and places no geographic limits: anywhere you can connect with fellow fans. UGC is the hook – the CEO notes fans “want to create content as much as consume it”. Traction: First customers included Qatar 2022 (Fanera won the Challenge22 startup competition). Growth has been organic through influencers and football communities. Monetization: App remains free for fans; clubs and sponsors pay monthly SaaS fees for fan analytics, targeted marketing and merchandise sales tools. Fanera also explores affiliate deals and branded content sales.

SaudiQick (KSA) – Features: Integrated fan platform connecting Saudi and MENA fans with clubs/leagues. Offers news aggregation, team chat rooms and polls, live streaming with interactive chats, mini-games and even AR stadium navigation for in-person attendance. It also embeds commerce: fans can buy tickets and official merch through the app, with QR-entry and ticket resale functions. Monetization: Freemium model (core app free, premium tier for extras) plus commissions on ticket/merch sales and targeted advertising. SaudiQick emphasizes first-party fan data – their pitch includes “valued fan engagement data” for clubs. In short, SaudiQick aims to be a one-stop digital fan hub, leveraging the gulf’s sports boom (Vision2030) with features beyond pure gaming.

Eksab (Egypt/MENA) – Features: Focused on fantasy and prediction contests. Users build fantasy squads for European and local leagues via free or paid pools. The platform includes leaderboards and cash/merch prizes for top performers. It has also added content (news, stats) to keep fans in-app between games. Traction: Launched 2018; $3M seed in 2022 to expand across MENA/Africa. Monetization: Takes a cut of entry fees on premium contests and merchandise sales. Their long-term vision explicitly includes Web3 elements (NFTs, tokens) to deepen engagement.

Media and Big Tech Initiatives: Outside apps, major players are targeting young fans via content. FootballCo’s Yalla Goal/Girl shows (via GOAL.com) use TikTok/Shorts formats; the Yalla SPL series reached hundreds of millions of views. The Saudi league’s TikTok partnership launched an “SPL Hub” for exclusive clips and creator collaborations. Sports broadcasters globally are similarly pivoting: personalized, short-form content and community-driven features are now priorities (altman solon notes “lean into fan data” to tailor experiences).

Monetization & Fan Data

These engagement models not only capture attention, they unlock new revenue streams and data assets. Apps like Fanera and SaudiQick will monetize via B2B deals: monthly subscriptions from clubs/brands for fan analytics and direct-to-fan sales. Fantasy/gamification platforms earn from contest entry fees, branded giveaways and partner sponsorships. Others may try freemium levels, merchandise marketplaces or loyalty rewards (e.g. points for stadium tickets or partner discounts). Most importantly, early entrants accumulate first-party fan data: real-time info on who fans are, how they engage, what content resonates. This could include preferences (which teams, players), consumption patterns (videos watched, polls answered), and even purchasing intent (ticket buys, merch clicks). As Altman Solon points out, “engaging younger fans will start with leveraging fan data around live experiences”. In practice, this means a successful app can personalize content (push notifications, tailored clips) and create targeted ad/sponsorship opportunities. The platforms themselves become valuable “fan hubs” for clubs: they can know exactly which 18–25-year-olds are most passionate about a given team or player.

Why Now? First-Mover & Regional Growth

Pressplay’s LPs should note the confluence of factors creating a unique opportunity. The Middle East’s sports and digital economies are simultaneously exploding: governments are pumping billions into domestic football, MENA e-commerce and tech markets are growing (projected ~$50 billion by 2025), and youth are enthusiastically adopting new media forms. A first-mover in fan engagement can lock-in partnerships with leagues/clubs and capture network effects before global giants dominate. Early leaders can set the standard for how the next generation experiences football. Moreover, the region’s startup ecosystem is maturing: accelerators, government innovation funds and capital flows (e.g. MBRIF, Flat6Labs investments) support sports-tech pioneers. The risk of not acting is missing out on a vast captive audience. By building a mobile, social-rich fan community now, a startup (and its investors) gains a beachhead in a market where competition is just emerging. Over time, this translates to a data- and loyalty-rich franchise analogous to an e-commerce user base – powering ad revenue, premium content, and even new ventures (e.g. gaming or financial services) around sports. In summary, Middle Eastern football presents a massive generational opportunity. Gen Z fans here outnumber their Western peers and increasingly demand interactive, reward-driven, social experiences. Early-stage platforms that tap this wave with gamified, UGC-friendly apps stand to capture huge engagement and proprietary fan data. For frontier-market investors, the upside is twofold: profit from the growth of sports and digital economy in the region, and help define the future of fandom for a passionate, young demographic.

📬 Subscribe to our newsletters for deep dives into the attention economy & media-tech:

Mehtta Ventures Dubai (Attention Economy) – Subscribe here

The Streaming Lab (Streaming Industry) – Subscribe here

+ 🎙️ Follow our Pressplay Podcast for conversations with leading entrepreneurs (and VCs coming up) in the space:

Watch on YouTube – Pressplay Capital

> PressPlay is where the attention economy meets real builders.

> We’re excited for the future of media-tech and AI-driven streaming—and look forward to partnering with those who share our vision.

Interested Investors / Limited Partners, please go ahead and book time with us here

If you know of startup founders building in the “eyeball economy”, please go ahead and connect us. Let’s pay it forward together :-) 2025 it is!

Watch this space and subscribe / share with your friends.

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brand across 7 billion + impressions per month including 150+ publishers, OTTs and broadcasters in the Middle East and several more in India, APAC, Europe and the United States. Contact me here.