Unveiling FIGG: Redefining Wealth Intelligence in the UAE and UK Markets

Discover the Future of Wealth Management with FIGG's Groundbreaking Technology and use of AI

Hey founders, funds, & friends 👋,

A warm welcome to the 9th edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about startup stories across the Middle East & India, digital / business trends shaping our lives and curated investment opportunities.

If you are not already a subscriber, please sign up below and join several others who receive it directly in their inbox every Monday.

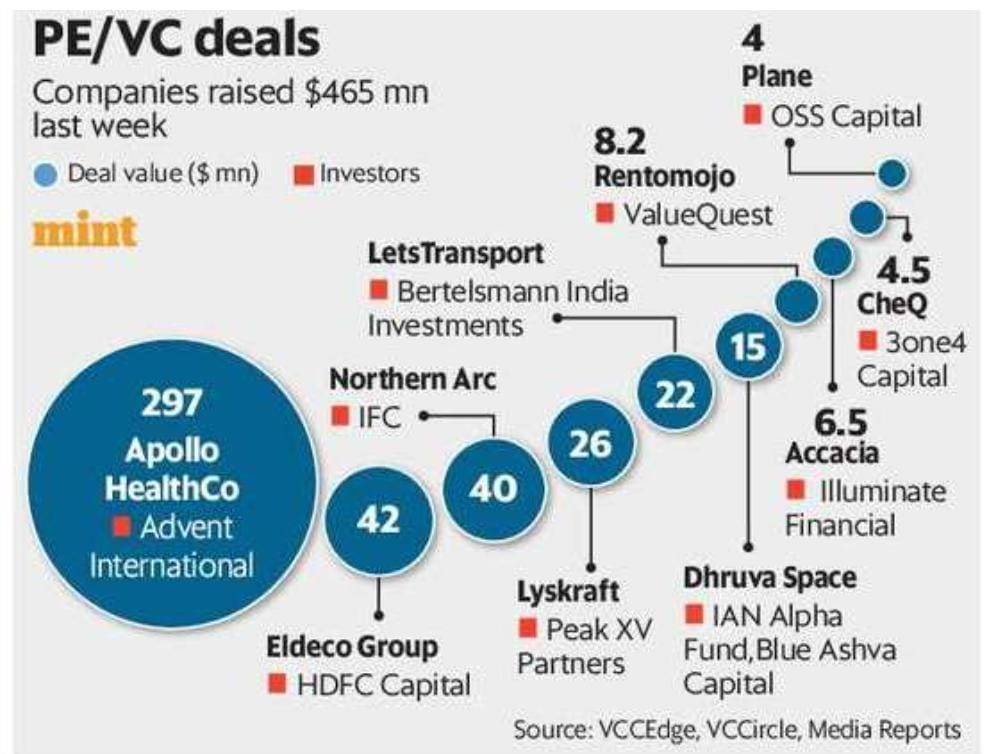

^ this is data referring to deals in the Indian VC / PE space for April 22 - 27.

Breaking down the companies that raised successfully as per the information above (also gives us a few hints as to what kind of sectors are hot and happening with investors today, at least in India)

Plane: an open-source project management platform, announced that it has secured $4 million in seed funding from OSS Capital. This investment will fuel the company’s community growth and help it compete in the coveted enterprise segment.

Coinciding with the funding announcement, Plane unveiled Plane One, a first-in-open-source pricing plan for self-managed instance owners at growing companies, as per a company statement.

CheQ: a Bengaluru-based B2C credit management platform, has raised Rs 35 crore or approximately $4.5 million in an extended seed funding round, according to an Entrackr report.

The recent financial infusion comes after a significant 18-month period without funding. Founded in 2022 by Aditya Soni, CheQ offers a unified platform where customers can manage various credit products, pay credit card bills, and handle EMIs all in one place.

Accacia: a decarbonisation platform focusing on the real estate and infrastructure sectors, has successfully closed a $6.5 million pre-Series A funding round. Accacia, initially established in Asia, has already deployed its solution to over 25 million square feet of commercial real estate, with Singapore emerging as a significant market, contributing approximately 70% to its revenue.

Rentomojo: Online furniture rental startup Rentomojo has raised an undisclosed amount from ValueQuest Scale Fund in a Series D funding round. The latest investment by ValueQuest includes a mix of primary investment and secondary purchase for a minority stake in Rentomojo.

Dhruva Space: Spacetech startup Dhruva Space has raised $9.4 million (Rs 78 crore) in a mix of equity and debt from IAN Alpha Fund, Technology Development Board and other existing investors in its latest funding round.

The capital infusion, of which Rs 24 crore was in debt, will help the Hyderabad-based startup set up its first phase of its 2.8 lakh sq ft spacecraft manufacturing facility in the city.Letstransport: the truck aggregator startup, has raised $22 million in a funding round led by Bertelsmann India Investments.

The round also saw participation from Rebright Partners, NB Ventures, ALES Global, Stride Ventures, CAC Capital and others.Lyskraft: a fashion start-up, has raised $26 million in seed funding, as per a report by the Economic Times. Led by Myntra’s founder Mukesh Bansal and the former senior executive of Zomato Mohit Gupta, the start-up's funding makes it one of the “largest early stage rounds.”

Northern Arc: Non-banking lender Northern Arc has raised $80 Mn (INR 667 Cr) from World Bank Group’s private-sector investment arm International Finance Corporation (IFC) in equal halves of equity and debt components.

Northern Arc will use the fresh capital to further its expansion and widen reach to end customers.

Eldeco Group: Eldeco Infrastructure and Properties, a part of the Eldeco group, has raised Rs 350 crore from HDFC Capital Advisors Limited for their joint platform to do residential projects across the country.

Apollo Healthco: The firm announced that it will raise ₹2,475 crore (approximately $300 million) through private equity firm Advent International for its unit Apollo HealthCo. This unit manages Apollo's Apollo 24/7 vertical. Additionally, there are plans to merge Keimed, a promoter-owned wholesale pharma distribution business, with Apollo HealthCo over the next 24 to 30 months.

Today’s program:

The Global Wealth-tech Market

Examples of Wealth-tech startups in the Middle East

Startup Deal #9, Figg - AI-driven Wealth Consolidation & Analytics

Platform

And….Action!

The Global Wealth-tech Market

The global wealth-tech solutions market is expected to record a CAGR of 17% during the forecast period ranging from 2023 to 2033. The wealth-tech solutions market is projected to grow from US$ 5.42 billion in 2023 to US$ 26.1 billion in 2033.

New cutting-edge technological advancements and an increase in demand for digital tools are expected to increase the demand for wealth-tech solutions. This provides a positive platform for wealth-tech solutions in the market to grow in demand.

Millennials and Gen Z are fast becoming the primary consumers of financial products and services, resulting in a growing demand for innovative digital solutions, which wealth-tech companies are poised to meet in the near future. A growing number of wealth-tech solutions are offering ESG-focused investment options to suit the needs of investors who are increasingly concerned about environmental, social, and governance issues.

A few examples of wealth-tech solutions include robo-advisory, digitizing retirement assets, automation of processes/outsourcing, digitized customer relationship management, and extensive financial data analysis. WealthTech solutions also provide strategic planning for integrated cash flows, employer stock modeling, complex tax planning, strategic estate planning, and legacy planning among others.

Examples of Wealth-tech companies in the Middle East

Baraka: Baraka is an investment platform that empowers you to make informed and strategic long-term investment decisions. Access a comprehensive suite of products, innovative tools, and real-time market insights to build wealth aligned with your financial goals and values. Raised a total of $25 million.

Neo Mena Technologies: Neo Mena Technologies is a UAE-based financial technology services company with a focus on providing digital investment services to regulated entities within the GCC. Raised an undisclosed round.

Sarwa: Sarwa is a financial platform and app that lets you easily trade stocks and ETFs, save and invest your money passively all in one place. Raised $25 million till date.

Startup Deal #9: FIGG - AI-driven Wealth Consolidation & Analytics Platform

Industry: Wealth-Tech

Headquarters: Switzerland & Dubai, UAE

Fund Raise Ask: $4.5 million pre-series A

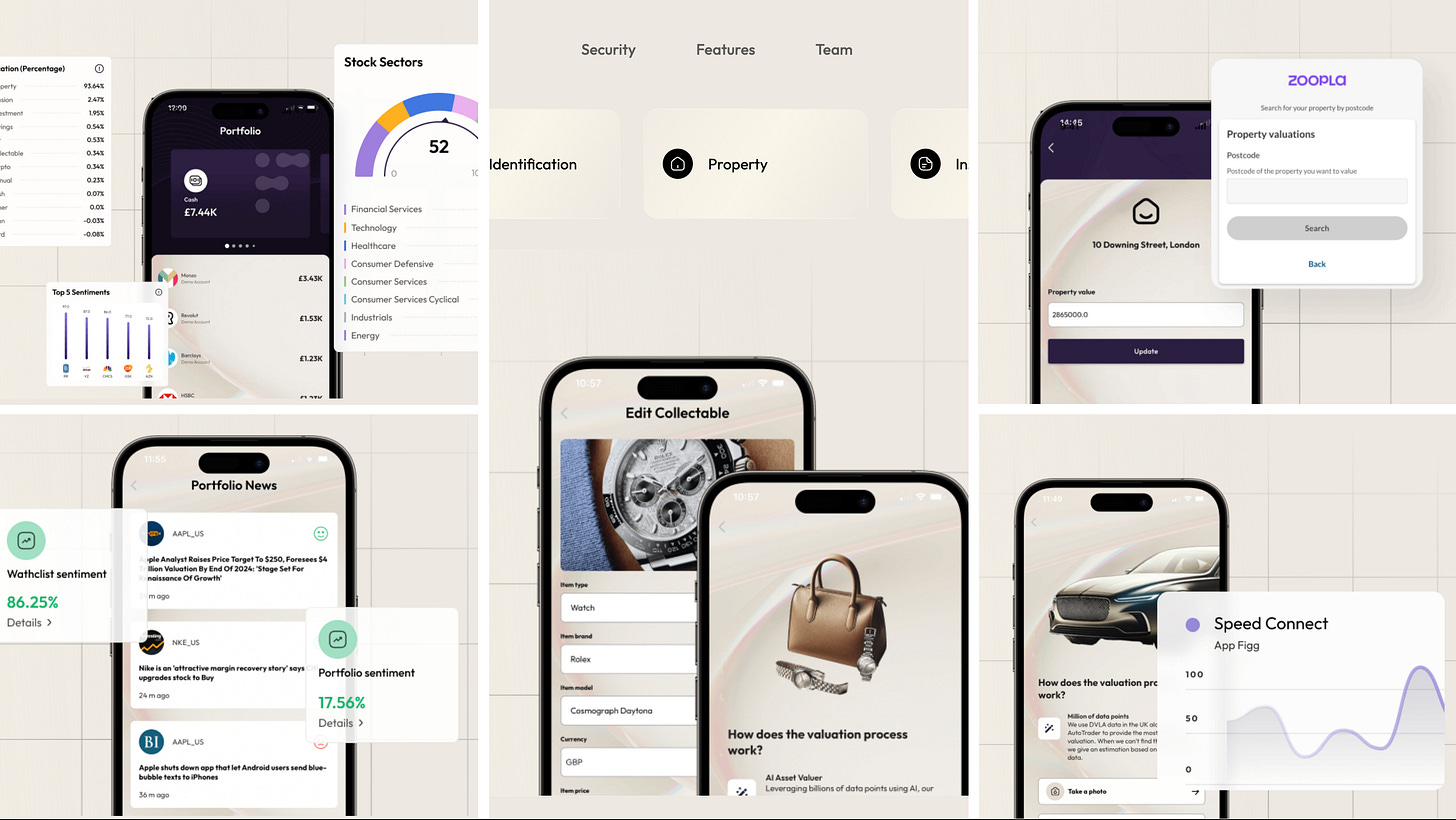

Traction: The platform's comprehensive integration of over 2000 custodians and 150,000+ stocks, surpasses the scope of open banking. With unrivalled coverage of UAE banks and a pioneering stance in the market, Figg holds a significant first-mover advantage. Features include Ask-FIGG AI engine, AI Sentiment Analysis, AI-Camera Asset recognition, vehicle valuation and lots more

Founder: Sahba Hadipour

Business Model: B2B2C

The banking industry is grappling with a monumental challenge: adequately serving the needs of the 'mass affluent' clientele. Enter FIGG, an innovative wealth intelligence solution that presents a compelling investment opportunity tailored specifically to the UAE and UK markets.

FIGG rises to this challenge by leveraging cutting-edge AI tools to offer a unified wealth intelligence platform. This platform seamlessly consolidates assets from a myriad of sources, including banks, trading platforms, crypto wallets, and physical holdings like real estate and luxury items. What sets FIGG apart is its ability to provide actionable insights, sentiment analysis, and bespoke analytics without requiring asset transfers or monetary deposits. Moreover, FIGG offers both direct consumer access and a white-label B2B2C solution.

Led by a team of seasoned C-suite financial and technology executives with expertise spanning AI, technology, and financial services from renowned institutions such as LGT, Merrill Lynch, Julius Baer, JP Morgan, Barclays Wealth, and EFG, FIGG is primed for success.

FIGG's achievements are underscored by its platform's comprehensive integration of over 2000 custodians and 150,000+ stocks, surpassing the scope of open banking. With unparalleled coverage of UAE banks and a pioneering stance in the market, FIGG boasts a significant first-mover advantage. Its AI-driven sentiment analysis and expansive coverage of liquid and physical asset types further differentiate it from competitors.

The company's unique position as a first mover in the UAE and UK markets, coupled with its innovative use of AI and diverse revenue streams, positions it for exponential growth. FIGG's mission to democratize wealth management is aligned with its tailored approach, expansive asset integration, and cutting-edge technology.

In summary, FIGG represents a company with a robust foundation and innovative technology poised for significant growth and market dominance in the untapped UAE and UK markets. Don't miss the opportunity to be part of this groundbreaking journey with FIGG.

Setting It Apart:

FIGG sets itself apart with its unparalleled coverage of UAE banks, pioneering stance in the market, and innovative AI-driven sentiment analysis, marking a significant first-mover advantage in the wealth intelligence landscape. Also, the founding team comes from a core financial services & technology background with many years of experience helping customers succeed in their financial journeys. Lots of exit options available to investors as the platform’s user base and data driven features expand.

Please get in touch if you OR someone you know is interested to invest in FIGG OR if you just want to have a chat around startups and investing!

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brands across 6 billion + impressions per month. Contact me here.