Wamda's Digital Digest for MENA - A venture market analysis for the month gone by

+ Startup Deal #2, The Secret Skin, GCC's largest tech-enabled platform for Sustainable Beauty & Wellness

Hey founders, funds, & friends 👋,

A very warm welcome to the 2nd edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about startup stories across the Middle East & India, digital / business trends shaping our lives and curated investment opportunities.

If you are not already a subscriber, please sign up and join several others who receive it directly in their inbox every Monday.

Today’s program:

Wamda Capital

Wamda Digital Digest - Comparing Feb ‘23 to Feb ‘24

Startup Deal #2, The Secret Skin - GCC’s largest tech-enabled platform for Sustainable Beauty & Wellness

And….Action!

Wamda Capital

Wamda Capital accelerates entrepreneurship ecosystems across the Middle East and North Africa region through its sector-agnostic investment vehicle, which invests in high-growth technology and tech-enabled startups - most people in the region on both the investor and startup side agree that they are the region’s most active venture fund.

They run two funds - ‘Wamda Capital - Fund I' and 'Wamda Capital - Evergreen Fund'~ total raised approximately $126 million.

Fadi Ghandour is the Executive Chairman of Wamda Group and amongst the earliest “MENA superstars” for startup success and exits.

Fadi was the co-founder of Aramex, one of the leading global logistics companies based in Dubai. Fadi spent the first 30 years of his work life as CEO of Aramex, building the company, to become one of the leading emerging market logistics companies, and making it the first company from the Arab world to be listed on Nasdaq.

Wamda’s Digital Digest - Comparing Feb ‘23 to Feb ‘24

Wamda’s Feb ‘24 digital digest tracking MENA investments shows a significant year on year drop on the funds raised by startups in the region.

Major changes include significant drops in funds in Saudi Arabia & Egypt (down 95% and 99% respectively).

Algeria, Tunisia, Oman and Yemen do not appear in Feb ‘24, Kuwait makes it’s debut on the list and Bahrain sees a 98% funding drop this Feb compared to Feb ‘23.

Feb ‘23 highlights - Egypt’s MNT-Halan attained unicorn status after scooping up a $400 million round at a post-funding valuation of over $1 billion, placing Egypt in first position in terms of the funding amount. Saudi Arabia came in second with $316 million spread over 13 deals. The amount was largely led by e-gifting marketplace Floward and foodtech startup Nana, raising $156 million and $133 million respectively. The UAE was a distant third, attracting just $8 million raised across seven deals.

Feb ‘24 highlights - The UAE remained at the top of the MENA ecosystem in terms of investment, with its startups raising $65.6 million across 22 deals, half of which went to the Flare Network. Saudi Arabia’s startups raised the second highest amount with $16.3 million across seven transactions, while only two Egyptian startups raised $4.6 million.

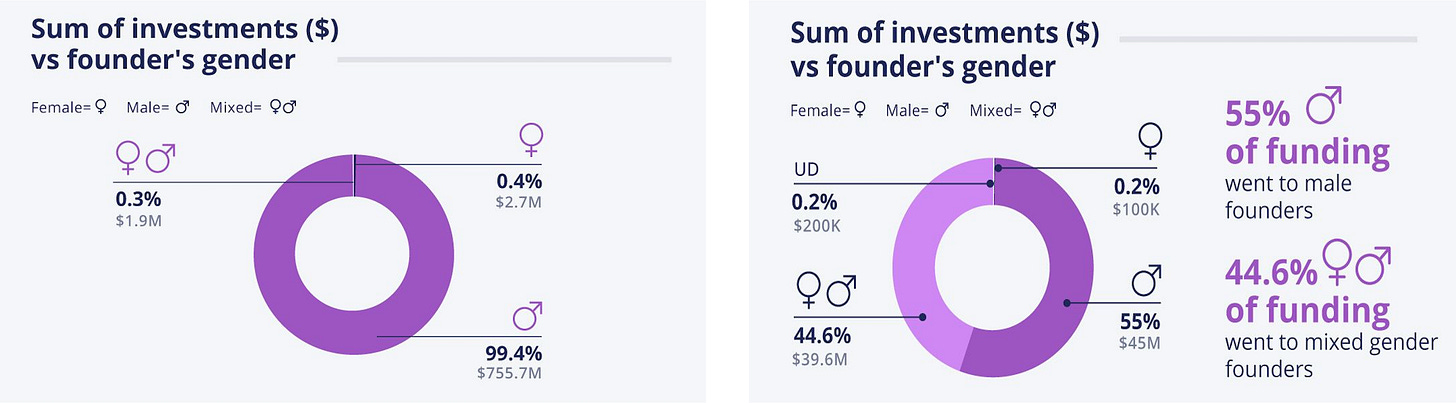

The numbers and charts speak for themselves, however the number of startups funded between Feb ‘23 (left image) and Feb ‘24 are not that much apart with 48 and 37 startups respectively, however the average ticket size was $15.83 million in Feb ‘23 and $2.4 million in Feb ‘24 ~ 85% year on year drop.

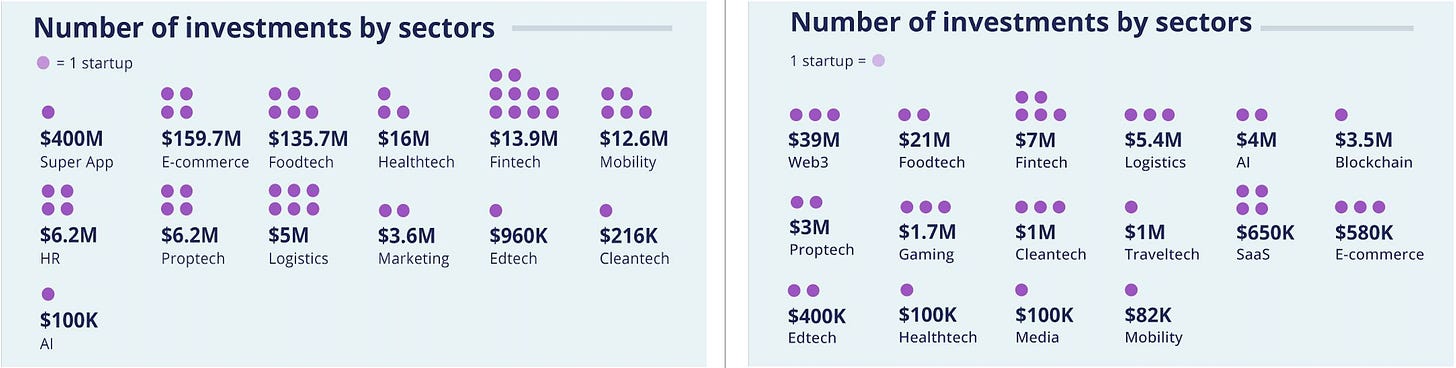

Female led startups in MENA have a massive head room for growth when it comes to getting funding from VCs - Feb ‘24 (right) saw a total raise of $100K only for female funded startups which is also down significantly from last February (left image) ~ drop of 96% year on year. With a plethora of "woman” founder (s) focused funds being launched in MENA, this is a space of massive growth and we will be tracking developments as new female founders and fund managers / investors emerge in the MENA startup ecosystem.

Feb ‘23 highlights (left image) - In terms of value, late-stage startups comprised 93% of the funding activity. Meanwhile, early-stage startups secured most of the deals, driven by the graduation of 12 startups from Flat6Labs’ Cairo Seed programme. Notably, a major slowdown in funding was pronounced at the Seed and pre-Seed stages.

Feb ‘24 highlights - Investment in Seed stage startups continues to dominate, with 11 startups in the Seed stage raising $25.5 million in total.

Feb ‘23 highlights - The top three sectors that received the most funding were super app, e-commerce and foodtech, collectively accounting for more than 90 per cent of the funding activity. Healthtech, fintech and mobility were next on the list.

In terms of deal count, fintech came out on top as startups in the sector received 10 deals worth over $13 million. This was followed closely by logistics, mobility and HR.

Feb ‘24 highlights - This month, foodtech performed well in terms of the funding amount, securing $21 million in two deals, with $12 million committed to The Cloud's Series B round. In comparison, five fintech startups raised $6.9 million, while logistics startups received $5.4 million. Web3 providers are the market's rising stars this month, having raised $39 million in three rounds, led by Flare Network's $35 million.

Startup Deal #2: The Secret Skin, GCC’s largest tech-enabled platform for Sustainable Beauty & Wellness

Industry: Beauty & Wellness

Headquarters: Dubai, UAE

Fund Raise Ask: $1.5 million Seed round; 54% of the round is subscribed

Traction: Significant growth in GMV, revenues, and distribution - more information upon request

Founder: Anisha Oberoi

Business Model: B2B, D2C and B2B2C

We are thrilled to share exciting updates from The Secret Skin, MENA's fastest growing tech enabled clean beauty platform, dedicated to offering women in the GCC a content, community and clean beauty product led shopping experience using a variety of distribution channels.

The Secret Skin offers clean beauty products across face, hair, bath & body, makeup, fragrances, men’s grooming, wellness, and baby.

All the products are animal cruelty free, dermatologically tested, 100% nature derived (no harmful chemicals), non-toxic and pregnancy safe.

Started by ex-Amazonian and cancer survivor Anisha Oberoi, The Secret Skin was born out of Anisha’s own personal struggle to find toxin-free personal care while she was undergoing cancer treatment (she has been cancer free since the past decade). The frustration that Anisha felt was the inspiration to create a legacy women could trust.

We need a lot more woman entrepreneurs and funds focused on woman founders to make up the significant gap between the two genders in the GCC. Mehtta Ventures Dubai is proud to represent The Secret Skin’s fund raise journey and is in 100% sync with the founder and her mission - sustainable development & clean beauty with a focus on content, communities and of course commerce.

That’s all for today folks. If you enjoyed this breakdown, please consider sharing it with your friends and colleagues.

While you wait for our next newsletter, I encourage you to check out The Secret Skin! Don’t miss the product videos - great idea for any e-commerce startup to increase conversions.

And follow them on Instagram to see other stories of happy customers, pictures and videos of existing and upcoming products and a community of other women who are at the forefront of the clean beauty revolution.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.