What is the potential of On-Demand Corporate Housing marketplaces?

Nearsite: AI Powered, B2B Corporate Housing Marketplace expanding to the Middle East

Hey founders, funds, & friends 👋,

A warm welcome to the 19th edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about startup stories across the Middle East & India, digital / business trends shaping our lives and curated venture investment opportunities.

If you are not already a subscriber, please sign up below and join several others who receive it directly in their inbox every Monday.

Today’s program:

Strategic Trends in AI - The Rise of AI 2.0 and Humanoid Robotics

On-Demand Corporate Housing Startups

Startup Deal: Nearsite, AI powered, B2B Corporate Housing Marketplace

And….Action!

Strategic Trends in AI - The Rise of AI 2.0 and Humanoid Robotics

The Shift from AI 1.0 to AI 2.0

The world has been captivated by AI software and chatbots, notably ChatGPT, marking the era of AI 1.0. However, the tech vanguard is now shifting towards AI 2.0 — a leap into the physical realm through humanoid robotics that promises extensive economic implications.

Pioneers of AI 2.0

Elon Musk's vision for Tesla includes transforming it into a $25 trillion enterprise with its advancements in humanoid robots, particularly the Tesla Optimus model. This robot, capable of performing tasks ranging from domestic chores to more complex actions, signifies a potential major pivot from Tesla’s core automotive business.

Moreover, industry giants like Nvidia, Microsoft, Amazon, and OpenAI are investing heavily in this domain. Nvidia recently introduced Project GROOT Foundation AI model and a new system-on-a-chip for robotic use, underscoring the technological strides being made toward more sophisticated robotic capabilities.

Strategic Investments and Market Predictions

The investment flurry continues with Amazon, Microsoft, and OpenAI pumping substantial capital into FigureAI, a leading startup in humanoid robotics. Intel and Samsung are also significant players, positioning themselves within this burgeoning sector.

Implications for Investors and Markets

This new frontier presents lucrative opportunities for investors. With humanoid robotics identified as AI 2.0, the focus is not just on developing the technology but also on its integration into everyday life, promising a revolution in how we interact with machines.

Conclusion

As AI transcends from virtual assistants to tangible robots, the implications for productivity, lifestyle, and economic activities are profound. Mehtta Ventures encourages our strategic partners and stakeholders to closely monitor this space, as the investments we make today could redefine global tech paradigms and generate substantial returns in the near future.

Source: (Investorplace)

On-Demand Corporate Housing Startups

Today we have a look at some of the exciting on-demand corporate housing startups that are shaking up the corporate travel space, which has traditionally been relying on a myriad of travel agents, agencies and several booking web sites for employees to eventually end up frustrated with vacation style AirBNBs. On the other hand, employers end up paying significant more for expensive hotel stays and perks which end up hurting the bottom line. The pain is exacerbated for longer term stays where employees have to travel for contract work OR client site visits, which are back in action for work efficiencies and relationship building reasons.

In the corporate housing sector, startups typically focus on providing flexible, fully-furnished apartments for business travelers and relocated employees, offering more homely amenities than traditional hotels.

Blueground - Known for offering beautifully furnished apartments for medium to long-term stays, primarily targeting business travelers for stays over 30 days.

As per an announcement on May 28th, ‘24, Blueground just successfully raised $45 million in Series D funding (total raised $274 million). This round included investments from new players like Susquehanna Private Equity Investments, and familiar backers such as WestCap. In a strategic financial move, Blueground also secured a debt facility from Barclays, with contributions from Morgan Stanley, Deutsche Bank, and HSBC, replacing previous arrangements with Silicon Valley Bank.

This influx of capital will primarily enhance Blueground's technological developments and support new strategic initiatives, propelling the company's ongoing expansion. The endorsement from prominent investors and banking institutions reflects confidence in Blueground's robust financial health and its leadership in the flexible living sector.

Founded a decade ago by CEO Alex Chatzieleftheriou, a veteran business traveler, Blueground aims to transform the temporary housing market by offering more home-like living solutions globally. Currently, the company boasts a portfolio of 15,000 units across 32 cities worldwide (including Dubai) and serves over 4,000 corporate clients, including numerous Fortune 500 companies.

Blueground is expanding its business model through franchising and a Partner Network, moving towards a capital-light, high-margin strategy. The company recently signed franchise agreements to launch operations in Japan with Mitsubishi Real Estate Company and in Thailand with Chic Republic Public Company Limited, furthering its mission to offer the largest global network of move-in-ready homes for extended stays.

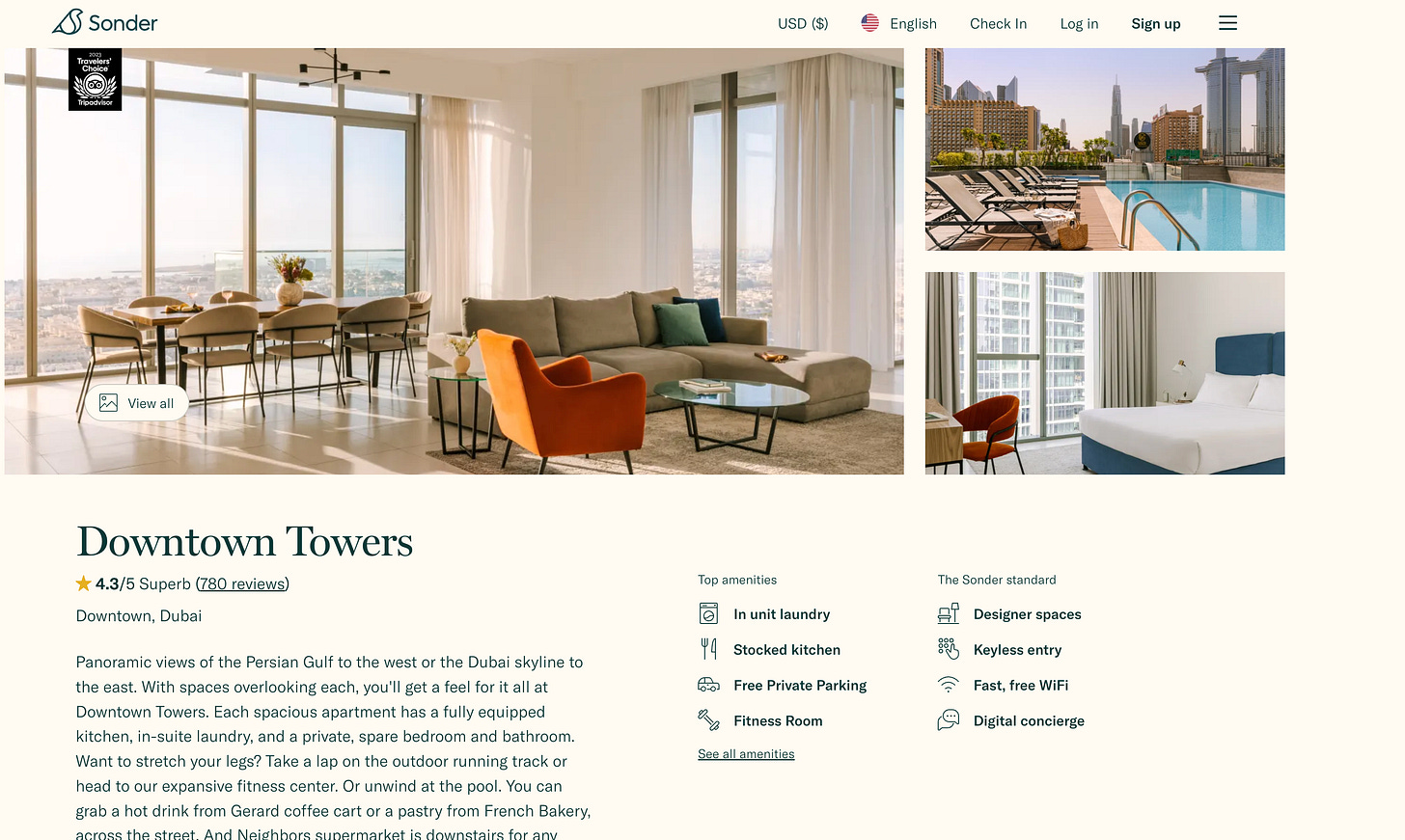

Sonder - While Sonder operates broadly in the hospitality industry, it has been increasingly catering to the corporate travel sector with its blend of hotel-like services and home comforts.

Latest information on Sonder reveals a mixed bag of performance and reputation -

Sonder Holdings, a provider of short-term apartment-style rentals, has recently streamlined its portfolio by exiting or renegotiating leases for 105 buildings, totaling 4,300 units. As part of this reduction, the company has already exited 60 buildings comprising 2,300 units and plans to continue this process throughout 2024. Alongside these strategic adjustments, Sonder has secured $10 million in new funding to enhance its liquidity.

From its latest SEC filing for Q3 2023, Sonder managed approximately 11,800 units across over 250 properties globally as of September 2023. The recent downsizing is expected to improve the company’s free cash flow by over $40 million annually, with termination fees costing less than $20 million.

Despite facing challenges, including a delinquency notice from Nasdaq due to delayed financial reporting caused by non-cash accounting errors, Sonder reports an increase in revenue to $164 million in Q4 2023 from $135 million the previous year. CEO Francis Davidson emphasized the resilience of Sonder's business and its ongoing efforts to optimize costs and achieve sustainable positive cash flow swiftly. The continued investor support underscores confidence in Sonder’s global brand and its financial stabilization initiatives.

Zeus Living - Specifically targets business travelers and has been recognized for its use of technology to streamline the rental process.

Alex Chatzieleftheriou founded Blueground in 2013, spurred by his frustrations with the lack of short-term furnished apartments in Europe during his tenure as a consultant for McKinsey. His experiences, which included exorbitant costs for inadequate hotel stays, motivated him to establish a solution that provided more suitable temporary housing options. Blueground has since become a significant force in the short-term, furnished apartment rental market.

During the pandemic, as remote work became commonplace, the demand for Blueground's services soared. However, as employers began recalling workers to offices, the overall demand for temporary housing declined. This shift impacted the industry unevenly, leading to the closure of some of Blueground's competitors, including Zeus Living, which shut its doors due to these changing market conditions. This highlights the critical importance of cash management in the volatile on-demand corporate housing sector. Unlike Zeus Living, Blueground has not only survived but continued to thrive, expanding its operations by acquiring other companies such as Tabas in Brazil and Travelers Haven in the U.S., and most recently, Nestpick, which expanded its network by 18,000 apartments.

Despite a challenging fundraising environment, particularly for proptech firms amid rising interest rates, Blueground's robust growth—evidenced by a 70% increase in sales to $560 million in 2023, and a gross margin of 35%—underscores the effectiveness of its financial strategies. These factors position the company for potential positive cash flow in 2024 and possibly an IPO.

These companies have been instrumental in redefining corporate accommodations by combining the flexibility of short-term rentals with the comforts of home, often enhanced with high-tech solutions for seamless customer experiences.

Startup Deal: Nearsite - AI powered, B2B Corporate Housing Marketplace

Executive Summary

Nearsite: Revolutionizing Corporate Accommodations

Nearsite is poised to transform the corporate housing industry, a market valued at over $132 billion, by leveraging artificial intelligence to streamline and enhance the way businesses secure accommodations for their workforce. Targeting a diverse clientele that includes corporate clients, government agencies, and relocation companies, Nearsite promises an efficient, scalable solution to the perennial challenges of business accommodation.

Company Vision

AI-Powered B2B Marketplace

Nearsite introduces an innovative marketplace powered by AI that systematically organizes global corporate demand with a network of vetted accommodation suppliers. This platform addresses critical pain points for both service apartment operators and their corporate clients:

For Operators: Broadens access to consistent, high-quality corporate demand, reduces customer acquisition costs, and minimizes revenue loss from vacant inventory.

For Corporates: Offers turnkey solutions for reliable, quality temporary housing, reducing the logistical challenges associated with employee relocation.

Technological Edge

Innovative Platform Features

Custom Requests & Bespoke Solutions: Tailored accommodations to meet diverse client needs.

Matching Engine & Contract Award: Streamlines the selection process ensuring optimal matches between demand and supply.

Automated Workflows & AI Tools: Enhances operational efficiency for both suppliers and corporates.

Feedback and Data Insights: Provides critical market insights, enabling proactive adjustments to offerings.

Market Strategy

Go-To-Market Phases

Phase I: Focus on sourcing demand from the US, India, and the Middle East for accommodations primarily in the US.

Phase II: Expansion to meet global demands with inventory in the US, UK, India, and the Middle East.

Product Offering

Range: From furnished apartments to unfurnished homes and apart hotels.

Flexibility: Accommodation durations ranging from a single day to long-term stays.

Target Customers

Broad Spectrum: Corporates, educational institutions, healthcare systems, and more.

Diverse Users: Executives, professionals, and specialized workers like traveling nurses and diplomats.

Financial Structure

Pricing Strategy

Marketplace Service Fee: Approximately 8% of the total transaction value, split between the supplier and customer.

Subscription Model: Potential monthly fees for suppliers to access advanced AI tools and data insights.

Seed Funding Round

Capital Raise: $3.0 million in Seed Preferred funding.

Incentives: Backed by attractive incentives from the NJ Economic Development Authority, including a 1:1 match up to $6.0 million and a 25% cashback offer for qualified VC funds.

Leadership

Seasoned Leadership

Piyush Sadana, Founder & CEO of Nearsite, brings over two decades of experience in B2B SaaS and real estate. His background includes significant roles at Norges Bank Investment Management and M&T Bank, augmented by an MBA from Columbia Business School. His track record includes two successful entrepreneurial exits, positioning him as a veteran leader capable of steering Nearsite towards substantial growth and market leadership.

Investment Appeal

Nearsite represents a unique investment opportunity in a rapidly growing sector with a visionary approach to solving long-standing industry challenges through technology. With its strategic market approach, robust technological foundation, and seasoned leadership, Nearsite is well-positioned to capitalize on the expanding market demand for flexible, efficient corporate housing solutions.

Contact Us

For more information about “AI startup” investment opportunities, please contact me at viniitmehta@mehttaventuresdubai.com OR book time via my scheduling link here.

Stay tuned to our newsletter for more exciting investment opportunities and industry insights and also share it with folks in your network who might be interested!

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brand across 7 billion + impressions per month including 150+ publishers, OTTs and broadcasters in the Middle East and several more in India, APAC, Europe and the United States. Contact me here.