Why 5-Minute, Vertical Series Can Be the Next OTT Frontier, but can they offer Venture Style Returns?

India’s Micro-Drama Moment

Hey founders, funds, & friends 👋,

A warm welcome to the 66th edition of the “Mehtta Ventures Dubai” investment digest newsletter, your weekly news digest about GAMES [Gaming, Ad Tech, Media Tech, Entertainment and Sports Tech] + AI startup and scaleup stories across the Middle East & India, digital / business trends shaping our lives and curated venture investment opportunities.

Go ahead and subscribe below to receive this newsletter with a fresh startup & investor perspective in your inbox every Monday.

Today’s program:

India’s Micro-Drama Moment: Why 5-Minute, Vertical Series Can Be the Next OTT Frontier, But Can they offer Venture style returns?

The format shift is real – and it isn’t “UGC-TikTok 2.0”

Early India signal: Bullet x ZEE5, Pocket FM’s spin-off, indie pilots

TAM & monetisation runway

Competitive landscape snapshot (H1 2025)

Risks & watch-outs

Our take

And….Action!

India’s Micro-Drama Moment:

Why 5-Minute, Vertical Series Can Be the Next OTT Frontier, But Can they offer Venture style returns?

1 | The format shift is real – and it isn’t “UGC-TikTok 2.0”

Short-form video in India has so far meant creator-generated lip-sync and comedy clips (ShareChat’s Moj, VerSe’s Josh, etc.). A very different wave is now brewing: professionally scripted “micro dramas” – tight, vertical-screen series told in 40-to-90-second episodes and designed for binge-watching on mobile. Think Wattpad stories meets K-drama pacing, delivered in a Reel.

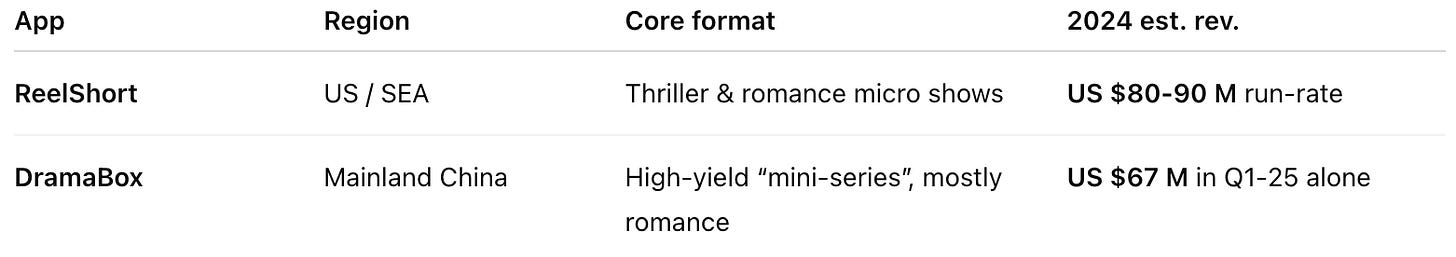

Global evidence is compelling:

Both apps monetise via episode unlocks (₹20-₹30 / $0.25-0.35 per bundle) rather than ads – a model already familiar to Indian users through fiction-audio platforms like Pocket FM.

2 | Early India signal: Bullet x ZEE5, Pocket FM’s spin-off, indie pilots

There are a whole bunch out there however listing a few here:

3 | TAM & monetisation runway

Viewer base – India’s daily short-video audience crossed 350 M in 2024 (RedSeer). Converting even 5 % to paid micro-drama viewers at ₹150/month ≈ ₹3,150 Cr (US $375 M) ARR potential by 2028.

ARPPU headroom – ReelShort’s US ARPPU is ~US $8/month. Early Bullet tests show Indian users paying ₹25 to unlock multi-episode arcs – 4-5× higher than typical UGC tipping.

Cost advantage – A 60-episode micro-series (total 45 min screen time) costs ₹12-15 L to shoot, vs ₹1-2 Cr per 45-min TV episode. Breakeven at ~500 K paid views.

Advertising tailwind – FMCG & fintech brands chasing Gen-Z eyeballs can buy sponsored seasons (title cards, product placement) at CPMs higher than YouTube Shorts because of storyline integration.

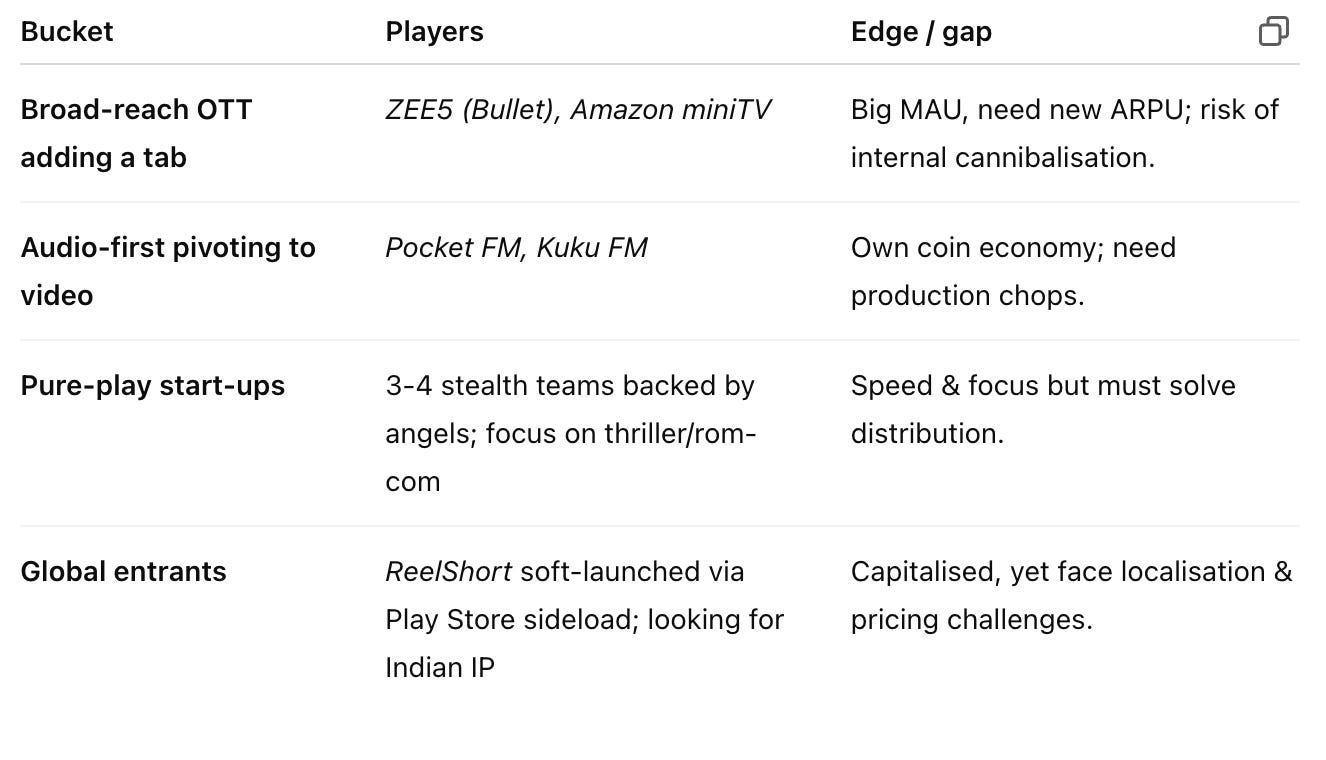

4 | Competitive landscape snapshot (H1 2025)

5 | Key investable themes we’re tracking

6 | Risks & watch-outs

Discoverability tax – Relying on Play Store and Shorts ads can be costly; partnerships with telcos (Jio, Airtel Wynk) may be decisive.

Censorship – Ultra-short dramas skate close to TikTok ban optics; foreign investors should structure via ADGM/Mauritius to buffer regulatory shocks.

Creator churn – Without robust revenue-share & data transparency, top show-runners may defect to YouTube or OTT studios.

7 | Our take

Micro-dramas sit at the intersection of mobile-first storytelling, impulse payments and AI-assisted low-cost production. India’s literacy with episodic coins (thanks to gaming & fiction audio) plus a 600 M Hindi-vernacular smartphone cohort make the timing uniquely favourable. The category’s unit economics look more like casual gaming than legacy OTT – exactly the power-law profile we target.

However, the king and queen are content IPs even in this space - folks who think and solve for this consistently - keep churning out engaging content which keeps the viewer coming back for more will win. Also, it’s important to keep in mind the discipline required to keep creating a “content treadmill” which is often underestimated. One can also not underestimate the power of AI for content creation - the consistency of Video AI tech for micro drama is not there yet, however how fast the experiments and final results are refined to be acceptable will determine the profitability of the space - keeping the content production costs in check.

It is not a very straightforward business and therefore the chance for outsized returns, provided you bet on a team that is solving for all of the above.

📬 Subscribe to our newsletters for deep dives into the attention economy & media-tech:

Mehtta Ventures Dubai (Attention Economy) – Subscribe here

The Streaming Lab (Streaming Industry) – Subscribe here

+ 🎙️ Follow our Pressplay Podcast for conversations with leading entrepreneurs (and VCs coming up) in the space:

Watch on YouTube – Pressplay Capital

> PressPlay is where the attention economy meets real builders.

> We’re excited for the future of media-tech and AI-driven streaming—and look forward to partnering with those who share our vision.

Interested Investors / Limited Partners, please go ahead and book time with us here

If you know of startup founders building in the “eyeball economy”, please go ahead and connect us. Let’s pay it forward together :-) 2025 it is!

Watch this space and subscribe / share with your friends.

While you wait for our next newsletter, I encourage you to check out our other newsletter / streaming consulting destination: The Streaming Lab where we cover streaming insights from MENA and India.

The “Mehtta Ventures Dubai investment digest” is a weekly newsletter exploring the trends that matter to startup founders and investment professionals in the Middle East & India. If you are not already a subscriber, sign up and join several others who receive it directly in their inbox every Monday.

Interested in investing with Mehtta Ventures Dubai in MENA & India? Email me

+ We work with startups, funds, other family offices and investment banks and help them upgrade their strategies, investments and market access. Contact me here.

+ We are on the Board of Directors of Adsolut Media, Asia’s largest digital video ad network. Please get in touch if you want to advertise to build awareness or generate leads for your brand across 7 billion + impressions per month including 150+ publishers, OTTs and broadcasters in the Middle East and several more in India, APAC, Europe and the United States. Contact me here.